Sign up for my FREE parent tips email and get my FREE Ebook on college financing!

Rising college costs put the student loan debt at an all time high. Paying for college is one of the greatest challenges when it comes to securing a college education for your children. While it seems that getting accepted into a college is the biggest hurdle, once they have received the acceptance letter, you can stop worrying about that and start worrying about how to pay for it. With tuition costs rising every year (nearly 500 percent in the last 60 years), most families find it difficult to cover college expenses. Financial assistance from the college is available to a lucky few, as are private and federal grants and scholarships. However, the vast majority of students will end up taking out student loans in order to pay for their education.

Rising college costs put the student loan debt at an all time high. Paying for college is one of the greatest challenges when it comes to securing a college education for your children. While it seems that getting accepted into a college is the biggest hurdle, once they have received the acceptance letter, you can stop worrying about that and start worrying about how to pay for it. With tuition costs rising every year (nearly 500 percent in the last 60 years), most families find it difficult to cover college expenses. Financial assistance from the college is available to a lucky few, as are private and federal grants and scholarships. However, the vast majority of students will end up taking out student loans in order to pay for their education.

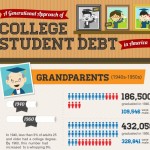

Picking which loan to take out is key. A loan, regardless of what kind, is something that will need to be repaid—which means your children will be in debt before they even start working. So, before you start applying for any and all student loans, find out more about the reality of the debt management post-graduation. This infographic clearly lays out the past, present and future of student loans and consider how it would impact your children’s financial outlook.

Extraordinary!

Thanks!

Its very informative Post which can guide students how to manage their education fee,if planning to take a loan against the course,so they can go through this post before coming to any conclusion,thanks for sharing your thoughts…