Although the thought of your child attending college brings forth feelings of pride and anticipation, if they are going to be living on campus, it’s understandable why it may also evoke a certain amount of concern. We all have read the news stories of unfortunate crimes that have happened at various colleges and universities across the country prompting you to investigate the security and safety of your child’s prospective colleges.

Although the thought of your child attending college brings forth feelings of pride and anticipation, if they are going to be living on campus, it’s understandable why it may also evoke a certain amount of concern. We all have read the news stories of unfortunate crimes that have happened at various colleges and universities across the country prompting you to investigate the security and safety of your child’s prospective colleges.

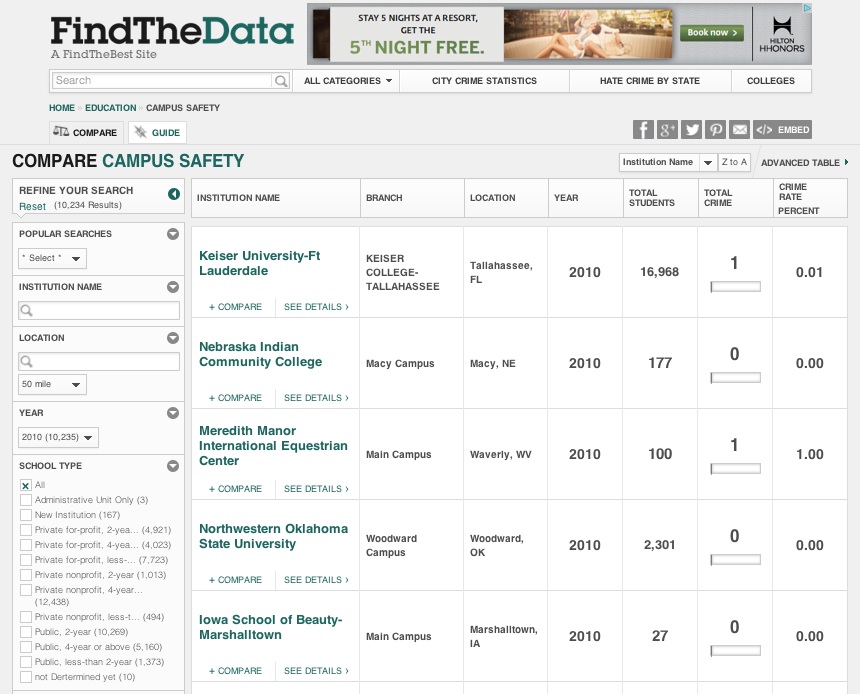

As matter of fact, just this past January, the Huffington Post published an article that featured the “Top 10 safest colleges within the United States”. Some of the schools on that list included Southern University at New Orleans, Virginia Western Community College and Erkskin College and Seminary in Due West, South Carolina. However, if your child is planning to attend another school, thanks to the Office of Postsecondary Education of the U.S. Department of Education, there is something called the Campus Safety and Security Data Analysis Cutting Tool that provides up-to-date information on alleged criminal offenses that have been reported to campus security offices across the country (you can read more about this at Ope.Ed.Gov/security).

But, if you would like a checklist of things to inquire about as it relates to your child’s college campus and its level of security, we have provided you with five things that can help to put your mind at ease below:

Ask if there is 24-hour campus security. Every college campus has security officers and most of them have patrol cars, but not all of them necessarily have 24-hour security that is available should your child need to be escorted to their car or dorm room very late at night. Therefore, it’s important to not assume that there is this kind of assistance available. Make sure to ask.

Look to see if the campus is well-lit (at all times). Something as simple as a broken light in a parking lot or in an alley in between builds can lead to a criminal act. That’s why it’s vital that you tell your child to make sure that the campus is well-lit at night and if they see any broken lights to immediately report it to campus security or the administration.

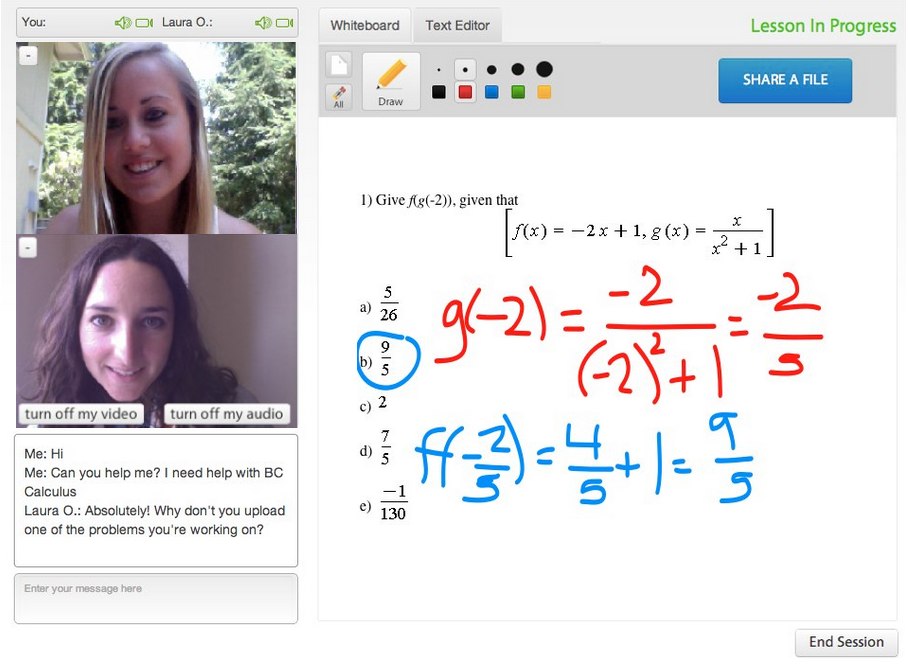

Inquire about self-defense classes. One wonderful thing about college is that there tends to be classes for just about anything that your student can think of. So, encourage them to see if there are self-defense classes that are offered on campus and if so, let them know how smart it would be of them to take a few.

Mention Safe Place USA. There is a a great deal of petty theft that tends to happen on college campuses. While paying the cost of a home security system for a dorm room doesn’t make the most logical sense, there is an alternative. If your child needs a place to store expensive jewelry and other really valuable items, one option to consider is Safe Place USA. It’s a company that specializes in providing in-room safes for universities. (SafePlace-USA.com)

Ask if it is mandatory to wear student/staff IDs. Another thing that sometimes leads to criminal activity is when people who are not students or staff are hanging out, constantly, on campus. One way to determine who is supposed to be on the grounds and who is not is for students and staff to have their ID on their person at all times. It might seem a bit tedious to do, but if it can help to keep people safe by making everyone aware of who is entitled to be on campus and who is not.