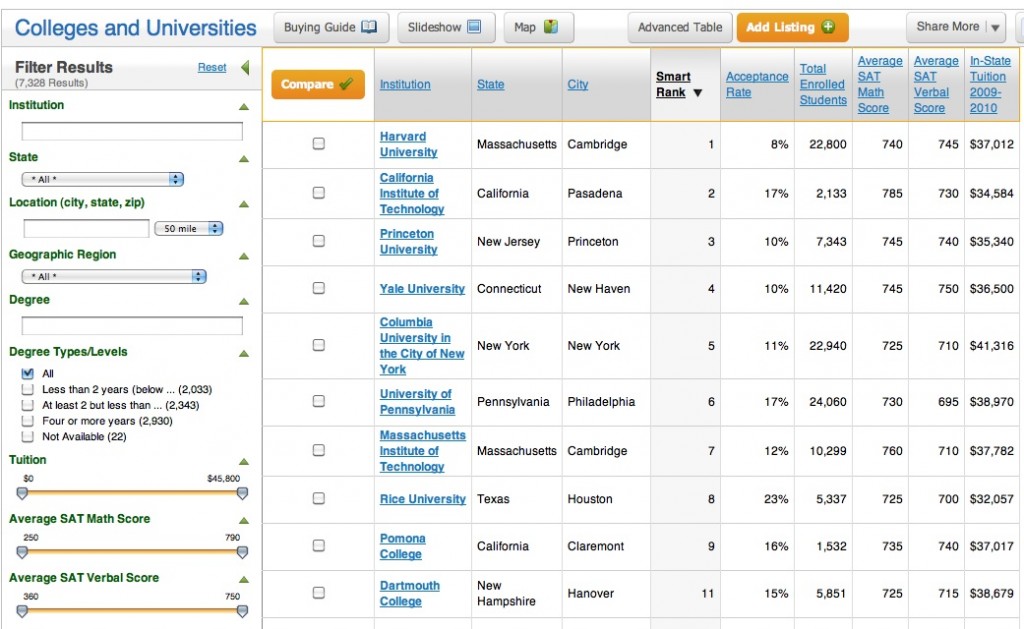

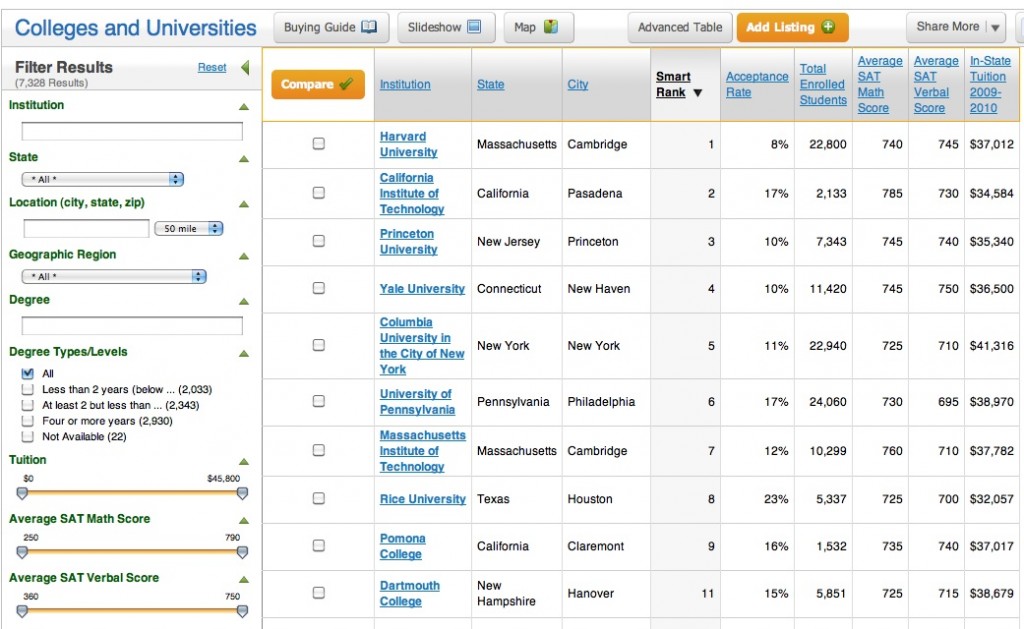

Last week during #CampusChat we talked about college search engines and their effectiveness in helping parents and students narrow down their college choices. There are many comparison tools out there, and today’s guest post from FindTheBest, offers parents and students some tips on how to conducting an in-depth side-by-side comparison search.

_______________________________________________________

Every fall the hype around college rankings consumes parents worried about whether their high school senior gets into a “Top 10 School.” Parents should remember, in the heat of admissions season, there are several factors that make a school right for your teen; there are also plenty of great schools out there, whether or not they’ve been recognized in top ten lists.

From school size to tuition, there are dozens of important things to consider when helping your child apply to college. Fortunately, a new college comparison tool helps you search for and compare colleges and universities by location, acceptance rate, tuition and more.

How to Search Beyond

The free tool, provided by the comparison engine FindTheBest, includes every College institution recognized by the Department of Education.

Looking for a small school on the West Coast with tuition under $25,000? Specify that criterion in the school filter and see what comes up in the search results. Can’t decide between a few schools? Conduct an in depth side-by-side comparison of up to ten choices, so you can review details about potential universities and see how they stack up against one another.

Because rankings are not the only consideration when it comes to choosing a college, helping your college-bound teen understand this alleviates concerns about not making it into a “top school”, by providing them with alternative choices.

This application season, do your homework; research various schools and what they offer and you’re sure to be happy with the outcome.