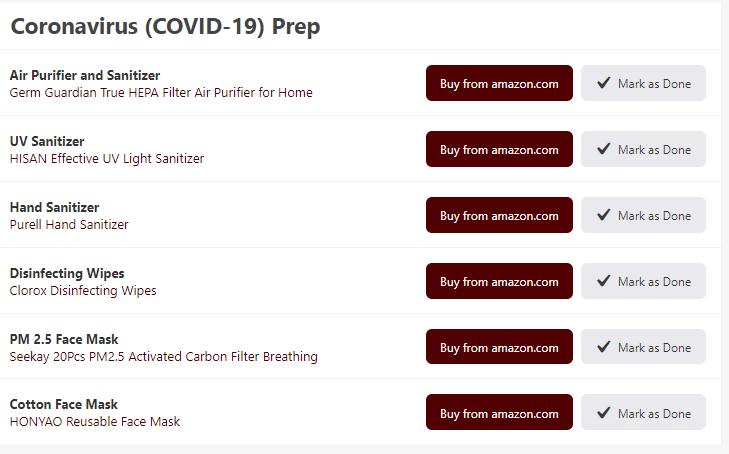

During these tough economic times, parents are committed to saving money on college costs. College tuition rises each year and there is little you can do about it; but there are other places that small savings will add up. Tuition will definitely be the huge chunk of your expenses. However, there are other expenses related to college where you can find some costs savings:

The expenses that cost the most

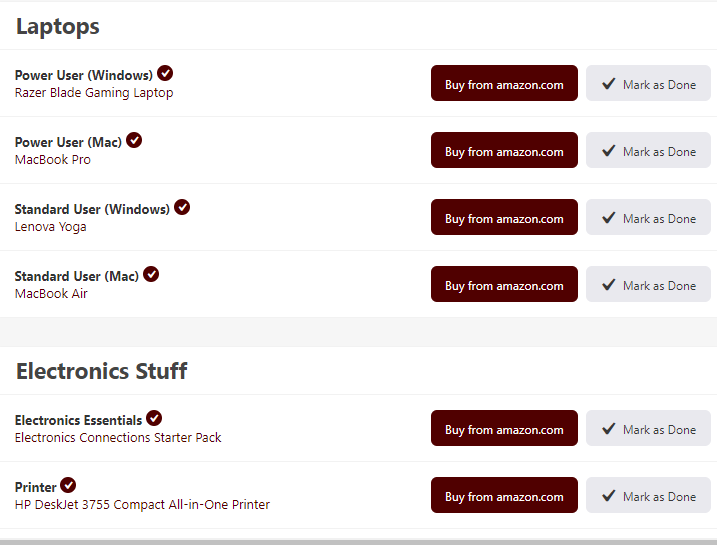

- Computers—In today’s technological world a computer is no longer a luxury, it’s a necessity. When your teen goes off to college, they will need their own computer. Personally, I recommend a laptop instead of a desktop. Since it’s portable, they can take it with them to class, to the library, and to group meetings. To save some bucks, shop online for refurbished or even last year’s models. If you buy online, consider purchasing a service contract to go along with your computer purchase (Note: This will pay for itself—I learned from experience!)

- Dorm furnishings—Most dorms come furnished with a bed, a desk and some sort of dresser. Beyond that, it’s up to you and your teen to decide what additional furniture and accessories they want. My recommendation is to buy used. You can find everything from small appliances (microwaves, coffeemakers, etc.) to furnishings (bookshelves, chairs and lighting) on Craigslist, Ebay or at local thrift stores. Be careful not to overload the room because they are traditionally small.

- Room and board—Room and board can be a huge portion of your teen’s college expenses. One option is to live at home if the college is within driving distance. Another option to save might be to purchase a home near campus and rent it out to other students, allowing your teen to live in it. Not only will this save you on room and board, but it will also provide you with an investment and tax write off as a rental. However, make sure the home is zoned as rental property. And here’s one of the best savings of all: after freshman year, your teen can apply to become an RA (Resident Assistant) in one of the dorms, which will provide you with a huge break on room and board costs.

- Meal plan savings—Most freshmen are required to purchase a student meal plan. But, there are usually options available. My recommendation is that unless your teen is an athlete with a large appetite, the full meal plan (3-meals a day) is costly and you will not get your money’s worth. Opt for the 1 or 2 meal a day plans. Most freshmen eat takeout with friends, microwave food in their rooms, skip meals periodically, and snack voraciously. Providing them with an in room fridge and microwave will save you some bucks in the long run.

Textbook savings

College students can spend nearly $1000-1500 a year on new textbooks. The good news is that you don’t have to spend that kind of money if you don’t want to. If you can, prior to the beginning of each semester, find out what books your teen will need (title, author and ISBN, or international standard book number). Then get busy and here’s a word of extra advice: DON’T WAIT UNTIL THE LAST MINUTE! (Note: Look at my List of Website Links in the Expert Links for all the links related to Textbooks)

- Buy used–Never buy new textbooks if it’s possible (unless you are a fan of throwing money away). Used books are just as sufficient. Most students use their textbooks only while they are in class and end up selling them back to the bookstore at an incredibly reduced rate. (Many times the bookstore won’t buy them back because the professor changes texts or the textbook has been updated). You can easily find used books online at discounted prices and your teen will arrive on campus with their books in tow and won’t have to fight the last minute panic rush.

- Try renting–There are numerous websites available that offer textbook rentals to students per semester. This is a fairly new concept, but seems to be taking off as more and more sites pop up offering this option.

- Purchase Ebooks–Consider purchasing electronic textbooks. With the recent introduction of the new Kindle College version, your student can download their textbooks and carry all of them with them. Without purchasing a Kindle, they can download the ebook versions and store them on their laptop for easy access. These versions are typically 50% less than the printed text version. The only downside is that not all textbooks are offered in ebook format.

- Share books–After freshman year, my daughter shared textbooks with her roommates. It was a huge cost savings. They were usually taking some of the same classes and would get together before classes began to discuss who would purchase which textbook. If your teen is a freshman, the likelihood of having the same courses as their roommate is extremely high. Sharing the book will save both of them money in the long run. There is also the option of using a library copy.

- Look for free books–There are a few sites that offer free downloads of some electronic texts. Before you purchase, visit those sites to see if any of the books you need are listed and downloadable.

- Evaluate the necessity—Do you really need the textbook? Wait a few days into class and get a feel for the professor. If he or she states that the tests will cover lecture notes, then consider not purchasing the book. Worst case scenario you can borrow one from a classmate if you truly need it or find a copy at the library.

The small things add up

It’s amazing how those little expenses can add up: gas, takeout, necessity items. But just as little expenses add up, small savings add up as well and you will be saving money on college costs.

- Ditch the car–Many campuses don’t allow freshmen to have a car on campus. But if your teen opts to live on campus and the college allows cars, consider ditching it. Everything your teen needs can be found on campus. And many colleges offer student transportation at very inexpensive rates if they need to leave campus or there is always the option of purchasing a monthly bus pass. In emergency situations, one or more of their friends will usually have a car that they can use or will offer to drive them.

- Use the student ID card for discounts–Most fast food restaurants and local eateries offer discounts to students with campus ID’s. Those small 10-15% discounts can add up.

- Finish in 4 years or less–Encourage your teen to stay on track and finish in 4 years or less. Most financial aid packages are only good for 4 years. Staying an extra semester will tack on additional expense and is not necessary since most degree plans can be completed in 4 years.

- Use family insurance coverage if allowed–Some colleges charge students for health plans. If you have a good family health plan, and the student insurance duplicates what is already covered, get any charges waived.