Between juggling lectures, assignments, and exams, staying organized can feel like a full-time job for students. While pen-and-paper methods still have their charm, today’s technology offers tools that make note-taking more efficient and effective. From hardware to apps, these note-taking tools can transform how students learn and succeed academically.

Continue reading Mastering Note-Taking in the Digital AgeCategory Archives: college apps

Surviving the College Application

You might not think the college application requires survival skills, but it does. It’s stressful and it’s no surprise the middle name of college-bound teens is “stress”. According to a recent survey, 76 percent of college-bound students say they are stressed. If you live with one, you’re stressed too; and not just you, but your family as well. Granted, there are plenty of reasons to be stressed. And plenty of reasons why it’s impossible to avoid feeling stress (try as you might). Surviving the college application requires tenacity on the parent’s part as well.

You might not think the college application requires survival skills, but it does. It’s stressful and it’s no surprise the middle name of college-bound teens is “stress”. According to a recent survey, 76 percent of college-bound students say they are stressed. If you live with one, you’re stressed too; and not just you, but your family as well. Granted, there are plenty of reasons to be stressed. And plenty of reasons why it’s impossible to avoid feeling stress (try as you might). Surviving the college application requires tenacity on the parent’s part as well.

Following are 6 stressful college application tasks and how to survive them:

The Grades

Grades mean everything. Your student’s GPA is one of the most important components of the college application (if not THE most important). It’s understandable that your child will stress over receiving B’s instead of A’s on their papers. They know that the college they want to attend looks at grades, classes, and GPA’s carefully before making an offer of admission.

What can you do? Create a positive study environment and don’t add to the pressure. If you see them struggling, get help. Let them know that all you expect from them is they do their best, nothing more.

The College Visits

Any parent who has been on a college visit with their teen will attest to the emotional roller coaster that often ensues. Your child may balk at the thought of getting out of the car, cringe at the fact that his/her parents are there along with them, and freak knowing they have an interview scheduled.

What can you do? Take a chill pill before you head out and remember your child is most likely terrified. This is a huge step for them and emotions are going to play a big part in the visits, even though you might see it as a critical step in the plan. Give them the freedom to express those emotions.

The Standardized Tests

Testing in itself is stressful. But standardized tests are incredibly stressful. It’s a timed test that affects the outcome of offers of admission. Scores are compared with other students and some consider them to be bragging material. They feel a low score means less options for college; a high score opens more doors.

What can you do? Under no circumstances should you nag your student about studying. Help them study. Encourage them to study. Provide tutoring. If the pressure is off, they will do better on the tests. Too much pressure (especially from parents) with students who are stressed already, will affect their ability to focus and relax on test day.

The College Choices

Making decisions is stressful without the added pressure of the impact of this one decision on your child’s future. They may act calm, cool and collected, but they feel the pressure to make the right college choices. The schools they choose will be evaluating them on their merit and overall success academically.

What can you do? Let them make their own choices. Guide but do not put your foot down and tell them they can only attend your alma mater or a college close to home. They need to make the choice themselves because they will be attending the college for the next four years. If they don’t like it, they won’t be happy and stay when struggles come.

The Money

Money concerns always produce mounds of stress. With the economy in disarray, that stress is compounded when families are trying to pay for college. When deciding on college choices, money should always be a factor. If your student knows what you can afford to contribute and what is expected of them, the stress will be minimal. Keep them in the dark and there could be added stress and disappointment when they apply to a school that is not financially doable.

According to The Princeton Review’s 2013 “College Hopes & Worries Survey”—an annual poll of college applicants and parents of applicants—stress levels are up while cost remains a driving factor in college selection. In fact, 79 percent said the state of the economy has affected their decisions about college—up 4 percent from 2012.

What can you do? Make time to talk about money with your child. Hoping your student will get a full ride scholarship is not realistic. You need to plan for the worst (little or no aid) and hope for the best (multiple scholarships and merit aid). If the college choices fall into your family’s ability to pay, when the financial aid award arrives it will be a much more pleasant experience. Especially if lack of money to pay does not affect the final decision.

The Waiting

This is probably the most stressful time in your child’s life, which means it is stressful for the parents as well. One student put it simply:

Because as decision day draws closer, and the (rather strong) possibility of rejection becomes more and more pronounced, I can’t help but think that my process, that my life, is entirely out of my hands. I know it’s irrational — I know that I’m still the one who will make the ultimate decision, that I’m the one who will decide what my future holds. But that’s my point — I’m not rational anymore. I’m just afraid.

What can you do? Celebrate the accomplishment of applying and provide distractions during the months of waiting. Reiterate that you will be proud of them and no matter what the outcome it’s not the end of the world. Rejection is tough on these teens, but strong parent support can help them see that there are always options available and sometimes disappointments turn into blessings.

The ultimate goal is to have a stress free household and to avoid freaking out, thus surviving the application process unscathed. This might be impossible, but keeping the “freaking” to a minimum will help your student reduce their stress. Stay calm and breathe. It will all be over soon.

Application Tips for Low-Income Families

Families and students with low-income backgrounds often find going to college a looming task. They don’t know where to start or how to push past the initial idea of college. I’ve compiled some tips & resources that we regularly use with our students to help make the trip to college more affordable. So, let’s just hop into it then!

One of the most expensive parts of applying that we come across first are the application fees. Oh my gosh the fees. Some college applications are free while others can cost upwards of $100. And those are state schools I’m talking about, not Ivy-leagues. So, how do you get around them?

-

-

- Counselors and Advisors.

Check in with your student’s school. Many schools have college advisors or counselors that have contacts at the schools your student might be considering. - ACT Fee Waivers.

ACT has this nifty little program where they will waive the registration fee for 2 tests if a student qualifies for free or reduced lunch and meets the other qualifications listed on this website. Some states have specific requirements as well for how to utilize these waivers so, I suggest doing a little more research to make sure you qualify. - Application Fee Waivers. These are some of the most useful pieces of paper you can come across.

- Most colleges have their own fee waiver processes they have specifically for low-income applicants. Most of the time you have to provide proof that your student was able to utilize an ACT Fee waiver to take their ACT. (See above for information on this.)

- The National Association for College Admission Counseling has a fee waiver as well that you can use once the school counselor has signed off on it.

- Ask.

If all else fails, call the college admissions office and ask if they provide any assistance. They are used to this question and it will not phase them a bit. If they respond with “I don’t know.” ask to speak to the recruiter for your area. They typically have a little more information available.

- Counselors and Advisors.

Another expensive part that we don’t often think of is postage. In our district we will mail the applications, supporting documents, and correspondence between the student and the college for them. I would definitely see if your student’s school has this service provided. If this isn’t available to your students, contact the college they are applying to and see if they will accept materials via email or fax.

Try to save money on your college visits. If you have a student that is interested in 5 or 6 different colleges, it can get expensive to visit them. We always recommend that students visit a college before making a final decision. To help students who can’t afford to visit, some colleges have fly-ins or diversity programs that allow students to learn about a school while staying on campus for a short visit. These programs for high school seniors usually cover part or all of students’ travel costs. There typically aren’t many spots open so, apply early and follow up often.

The last and most important tip is to complete the FAFSA. I cannot stress this enough. It could be the difference between having school paid for and having to come up with everything out of pocket. In order to complete the FAFSA, you’ll have to create a FSA ID for yourself and your student. Do not lose this. You have to have the same ID every year and if you have other children, you will need it for them when they go to college as well. After completing your FSA ID, make sure your tax information from last year is available and filed. If you didn’t file, you still have to complete the FAFSA. You will go to https://fafsa.ed.gov and complete the form. If you have trouble, your student’s counselor may be able to help.

I really hope these tips are helpful. There are other sneaky ways to save up for college but, these are the big four that we use regularly. Prepare. Be organized. And remember that you are working towards a better future for your student.

________________________________________________________________________

Today’s guest post is from Beth Thompson, who currently works at a public school as a college advisor in the Arkansas Delta. Before starting this adventure, she worked in various university career services offices assisting students with their pursuit of a career applicable to their field of study. She is experienced in rural as well as urban job markets and has a deep love for the Arkansas Delta. She has a great, supportive family and two apathetic but cuddly cats. Feel free to visit her at FromApptoCap.

-

The 4-1-1 on This Year’s Common Application

It looks like the widely used Common Application has taken some cues from the new Coalition Application.

The new changes to the 2017-18 Common App for colleges mirror features found in the Coalition App. Competition often creates innovation and the Common App has some much-needed updates. The Common App changes this year will benefit high school students and make the application more user friendly.

While these changes will be welcomed by students, it’s too early to tell whether or not they will bring with them glitches in the application system. Here are some possible complications that could arise as high school students attempt to use each new section.

1. Detailed Course and Grade Section

Previously, in order for colleges to see a student’s previous years’ class schedule, they either had to request it or wait and view it on the official transcript. Now a college can view a high school student’s academic performance before the arrival of the transcript. Students input their own grades and can view their own academic performance while in the Common App. This is an option that the Coalition App currently provides as well.

This consolidates the grade-reporting process within the Common App and allows colleges to have detailed information provided by the students themselves. It’s still not clear whether this option will be required or optional, but students should always provide as much information as possible when applying to colleges.

2. Integration with Google

Recognizing that many high school students use a cloud platform to create and collaborate on assignments, the Common App has added this feature to its 2017-18 version. This allows students to upload essays and high school resumes directly from their Google Drives into their applications.

It is possible that students will experience formatting and other glitches that sometimes happen with cloud documents. These changes could mean problems for students, but until the application is widely used, we won’t know about technical problems. High school students will be able to write, revise and proofread documents easily on any computer before uploading them to the application. Since many students use school or public computers, this function will make it easier for them to complete the process. This is another functionality that is similar to the one offered by the Coalition App.

For more changes and improvements, click here to read the original article on TeenLife.com

A Tool to Master the Dreaded Application Essay

The college application season is now in full swing and if you listen closely enough, you might be able to make out the tap-tapping of millions of seniors across the globe writing their application essays. If you happen to be one of those students or a parent of one, I’d like to introduce you to Edswell, an application essay management tool that makes the whole process a lot easier.

The college application season is now in full swing and if you listen closely enough, you might be able to make out the tap-tapping of millions of seniors across the globe writing their application essays. If you happen to be one of those students or a parent of one, I’d like to introduce you to Edswell, an application essay management tool that makes the whole process a lot easier.

So…what does it do? First, it gives you all of the application essay and deadline requirements for a student’s college list, in one click. Required, optional, supplemental, program-specific…all of them. Students often spend days or weeks getting all of this information, now they can get it in a few seconds.

Second, it provides a beautiful essay management system that automatically organizes, syncs, and version controls every draft (built on Dropbox). Instead of creating a folder and filling it with files, users simply click on the school and essay they want to work on – all drafts are viewable in an attractive feed-style format.

Third, it allows students to easily invite anyone to review a draft. Reviewers do not need an Edswell account. When the edited version is sent back to Edswell by a reviewer, it is incorporated into the feed for that essay, where differences between drafts are automatically highlighted.

Finally, it allows parents and counselors to track student progress. Sometimes seniors need a nudge…Edswell gives the nudgers the information they need to make it happen.

You can give the platform a try for free for 30 days, no credit card required to sign up. Just visit http://edswell.com and click “Free Trial.” Oh, and for those interested in more information, there’s a short video walkthrough on the website.

I’d like to end with a salute to the seniors who are undertaking the not-insignificant task of memorializing their narratives, stories, and experiences in their application essays. And Sam, if you’re reading this, I think it’s okay to start your Common App essay with “What’s a BA without a good burrito?”

_____________________

Alex Thaler is the CEO of Edswell and the author of “The Art of the Personal Statement.” He received his BA from UC Berkeley and JD from University of Pennsylvania. In his non-existent spare time he enjoys woodworking and dreaming about moving to Hawaii.

Alex Thaler is the CEO of Edswell and the author of “The Art of the Personal Statement.” He received his BA from UC Berkeley and JD from University of Pennsylvania. In his non-existent spare time he enjoys woodworking and dreaming about moving to Hawaii.

App Tuesday: 7 College Savings Apps

Saving for college is difficult, especially in today’s world. Add the rising college costs to the mix and your family finds it hard to save enough money to pay for college. It can be done, but it requires a commitment and the tools to make it happen.

Saving for college is difficult, especially in today’s world. Add the rising college costs to the mix and your family finds it hard to save enough money to pay for college. It can be done, but it requires a commitment and the tools to make it happen.

First, there’s the question of “How much do you need to save for college?” SavingforCollege.com provides an informative infographic walking your through the planning stage step-by-step. It might be shocking for some parents, but knowing what you need can help you plan.

Following are 7 college savings apps that can help you plan for the future:

1. College Save

If you have a smartphone or tablet, you now have a unique way to reach and teach your kids about the basics of saving for college. Small Steps, Big Dreams is a series of fun, interactive games and financial lessons designed to engage your kids and inspire them to be money-smart. The Small Steps, Big Dreams program is made up of three mobile applications for specific age rangers and is designed to make the overwhelming concept of saving for higher education manageable.

2. UPromise

Over a decade ago, Upromise was launched based on the philosophy that everyone should be able to afford a college education. Today, with millions of members, Upromise is helping make that a reality for many Americans. Memberscreate a college savings service that harnesses the purchasing power of parents, extended family, family, and students to make it easier to pay for college. They direct their spending to Upromise partners—including more than 950 online stores, 10,000+ restaurants, grocery and drugstore items—and earn money for college. Thus far, members have earned $850,000,000 and counting for college with their everyday spending

3. College Savings App

With the TIAA-CREF College Savings Planner, you can keep track of your college savings goals wherever you are. Use the College Savings Planner to model your college funding goals and how you plan to help meet them. With the College Savings Planner you can explore: where you are now with college savings; your projected college savings; how much college could cost in your timeframe; what you’ll probably need to invest to meet college costs; and setting a realistic, achievable action plan

4. collegeFund

Planning college savings is not an easy job. Many factors come into play: such as the cost of college education (tuition, room and board, other mandatory fees, books and computers), the award of scholarships, the financial aid, and so on. CollegeFund app is trying to help the parents (sometimes grandparents, and/or other family members if they are willing to chip in) to plan their kids’ college savings account. Given a set of input: current annual college cost, current savings, how much you plan to save annually, your kid’s current age, the age starting college, the age of graduating, the calculator will return how much the annual income you can expect from the college saving account vs. the future annual college cost (Coverage Ratio), and how much you have saved toward achieving the goal (Saving progress).

5. CollegeSavings

College Savings is an innovative App, which visually shows the projected cost of college in the future. College Savings illustrated the future value of savings using the current lump sum and monthly savings plan. College Savings shows the potential shortfall amount needed to cover the total cost of college. In addition it also illustrates any surplus amount remaining after covering the future cost of college. By adjusting the input, you can estimate the amount of lump sum and regular monthly savings that is required to cover the costs of your desired college.

6. College Saving Wiz

The COLLEGE SAVING WIZ app will help you with SETTING GOALS for college attendance; CALCULATING the estimated costs with inflation; CALCULATING monthly/yearly savings needs; and TIPS on ways to save and cut costs! Don’t worry if you don’t know the actual tuition costs or even the college your child may attend. Our app provides convenient average costs for you to use based on the College Board annual survey of college pricing for tuition/fees, room/board, books/supplies, transportation and expenses for Public in-state, Public out-of-state and Private Colleges. You just input some basic information and COLLEGE SAVING WIZ will calculate the goal amount you must save each period, adjusting for inflation.

7. Saving4College

With the TIAA-CREF Saving4College Savings Planner, you can keep track of your college savings goals wherever you are. Use the Saving4College Savings Planner to model your college funding goals and how you plan to help meet them.With the Saving4College Savings Planner you can explore: where you are now with college savings; your projected college ; how much college could cost in your timeframe; what you’ll probably need to invest to meet college costs; and setting a realistic, achievable action plan.

Comprehensive List of College Info Websites

Here’s a current comprehensive list of my picks for college info websites. Do you have any additional suggestions?

COLLEGE BLOGS

ParentingforCollege.com–You will find the MOST information ere olege news. Come here first to find the latest and bhest tools to hn our blog: college guidance, college planning, college coaching, and colelp you navigate the college maze.

TheCollegeSolutionBlog.com–An excellent resource for college-bound teens and their parents: admissions, testing, and financial aid.

UniversityLanguage.com/blog–Great blog articles about everything related to college admissions geared toward students.

GreatCollegeAdvice.com/blog–An excellent resource about the college admissions process providing expert advice helping students map their college journey.

USNews.com/Education–The education channel of U.S. News and World Reports providing the latest news and information related to college.

CollegeBasics.com–An excellent resource for information about college essays, college applications and high school resumes.

InsideHigherEd.com/blogs–Several different blogs related to higher education.

CollegeAdmissionsPartners.com/blog–An expert blog dedicated to helping students find the right college.

CollegeFocus.com/colleges–A virtual clearinghouse of blogs related to college life, parenting, college searches, etc.

Road2College.com–You can find just about any topic related to college prep at this site: financial aid, college planning, student loans, test prep, and more.

PARENT SITES

UniversityParent.com–A site where parents can ask questions, gather information, and download and view college guides and campus newsletters.

CollegeParentCentral.com–A blog created to give parents useful information about college and the college admissions process.

YourCollegeKid.com–A site with parent forums and other college prep tools.

CollegiateParent.com-A site dedicated to providing parents with information for their college students.

FINANCIAL AID

Fafsa.ed.gov–The official government website for the Free Application for Federal Student Aid.

SallieMae.com/plan–A FREE education investment planner that will help determine college costs, compare college costs, and provides information about student loan repayments.

SavingForCollege.com–Everything you need to know about financing a college education.

FinAid.org–An excellent resource for the answers to all your questions regarding college financial aid.

CollegeFinancialAidAdvisors.com–Help with the college financial aid process.

SCHOLARSHIPS

Chegg.com–A free service for students and parents where students can showcase themselves, connect with colleges, and search for scholarships.

Cappex.com–The place to go to find merit scholarships and academic scholarships from colleges across the country.

Scholarships.com–An extensive scholarship search engine that helps you search and schedule alerts for deadlines.

How2winscholarships.com–A guide for parents and students on how to effectively apply to and win scholarships.

COLLEGE VISITS

SmartCollegeVisit.com–Created to provide information about college visits, help parents and students plan, and view personal accounts from both parents and students.

CollegeWeekLive.com–A virtual college fair that sponsors free LIVE events with archived presentations, student chats, and college booths.

COLLEGE PLANNING

Cappex.com–A site created for students to help them simplify their college search, create a profile and search for scholarships.

CommonApp.org–The common application site used by 400 colleges and universities across the country.

PrincetonReview.com–The best value colleges list for public and private institutions across the country.

UPromise.com–UPromise partners return a portion of eligible purchase money back to you. Those earnings accumulate in your Upromise account until you decide to use it to invest in a 529 plan, help pay down eligible student loans or assist with college expenses—all tax-free!

CollegeBoard.com–It’s here you’ll find the CSS Profile application (required by many private colleges), register for the SAT, and read articles about planning for college.

CollegeXpress.com–A search site that groups colleges in categories and provides college “hot” lists (i.e. top college for late bloomers, colleges for students needing a second chance)

VolunteerMatch.org–Find local volunteer opportunities for your college-bound teen and teach them about the importance of giving back to their community with the added bonus of adding that service to their high school resume.

KnowHow2Go.com–A college planning site for college-bound students providing helps and aids from middle school to senior year: interactive and fun!

BigFuture.collegeboard.org–A planning tool to help parents and students get ready for college.

TEST PREP / TUTORING

TutorsForTestPrep.com–An SAT expert and coach offering tips to help your college-bound teen improve their SAT/ACT scores.

FairTest.org–The site for the National Center for fair and open testing providing information about colleges who do not use the SAT/ACT for admissions decisions.

QuincyTutoring.com–A resource to find a tutor and schedule a tutoring session.

LaunchpadEducation.com–Tutoring to help students with learning disabilities and ADHD.

TEXTBOOKS

ECampus.com—Find textbooks, sell textbooks, search for college supplies and college apparel all on this one site.

Chegg.com–A hub for students to compare textbook prices, study for exams, and choose the right courses.

RECRUITING

NCSASports.org–The college recruiting site for athletes.

BeRecruited.com–If you have a teen that’s a student athlete, they can create an online profile here and help colleges and coaches find them and be recruited.

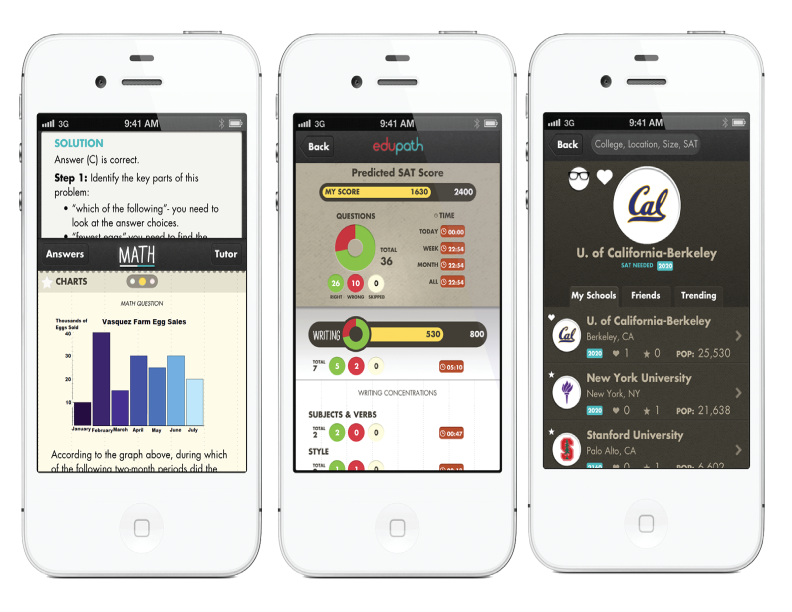

An app for parents and students from Edupath

Edupath is like three apps in one. College Explorer lets you browse 1300 colleges to find the right fit. SAT Training is optimized for short sessions so you can use it anytime, anywhere. And Dashboard, an Edupath exclusive, allows parents to follow along in real-time.

Edupath is like three apps in one. College Explorer lets you browse 1300 colleges to find the right fit. SAT Training is optimized for short sessions so you can use it anytime, anywhere. And Dashboard, an Edupath exclusive, allows parents to follow along in real-time.

Effective SAT prep starts with finding the right school. That’s why Edupath’s College Explorer helps students find the schools that fit them best, then train for the target SAT score of those schools. You can read what actual students say about their schools, and follow the schools that your Facebook friends are looking at.

Edupath offers SAT training designed for today’s students’ busy schedules. Students can develop their skills in short sessions that maximize information retention—and their time. The app has thousands of questions, written by PhDs from top universities, and tips and solutions for every question. Real-time analytics let you monitor your progress as you go.

The industry-first Dashboard for parents and counselors is the only solution for real-time tracking of students’ progress in the app and with any SAT class or tutor. You can track a student’s predicted SAT score, score improvement by section, time spent studying, and college choices.

Following are some screenshots of the app:

Download Edupath at edupath.com/download