Is your child considering a school that is out-of-state? More than likely, you want to give them the ability to attend any of the schools that they are considering. However, this is difficult when in-state colleges carry far less expensive tuition fees. We’ve compiled some tips for getting in-state tuition for out-of-state students to help families solve this cost dilemma.

Is your child considering a school that is out-of-state? More than likely, you want to give them the ability to attend any of the schools that they are considering. However, this is difficult when in-state colleges carry far less expensive tuition fees. We’ve compiled some tips for getting in-state tuition for out-of-state students to help families solve this cost dilemma.

1. Plan ahead

The more time you give yourself to plan, the more opportunities you will have to obtain tuition benefits. It pays to research, as many of your savings options can last through all four years of college. Also, it is important to apply to many of these benefits early, giving you preference over other applicants.

2. Understand the college’s rules

Some schools have stricter in-state tuition qualification requirements than others. It is important to research the rules for each school that your child may be considering. Some colleges require students to have graduated high school in the state or have a parent living in the state. Others allow in-state residency for students that live in the state for one year and are financially independent from their parents. It completely depends on each school. Check out Finaid.org for a list of links to each school’s rules regarding in-state residency requirements.

3. Fill out forms carefully

Make sure you completely understand the rules for each school so that you do not make any mistakes or omit any information when filing for residency. Be cautious when filling out forms and be sure to look them over before submitting them. If you have any questions, be sure to utilize the college’s admissions offices by giving them a call. As a result, you can be sure to submit the correct information.

4. Avoid penalties

Try to avoid the negative consequences of making a mistake. The penalties assessed to students for inaccurate in-state residency range from expulsion from school to being charged for past tuition at an out-of-state price.

5. Research academic reciprocation agreements

There are currently four regional programs that help students obtain lower out-of-state costs compared to the full out-of-state tuition. These programs are made available to students interested in specific majors. Students must qualify and there is usually a cap on how many students can receive this benefit from each college.

The Western Undergraduate Exchange helps resident of Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, North Dakota, Oregon, South Dakota, Utah, Washington, and Wyoming gain access to out-of-state schools. Students from one of these states are eligible to receive a reduced tuition rate of 150% of in-state costs at a school outside their home state. This includes two and four-year institutions. Again, this depends on how many spaces are available for WUE students at each school.

Alabama, Arkansas, Delaware, Georgia, Kentucky, Louisiana, Maryland, Mississippi, Oklahoma, South Carolina, Tennessee, Virginia and West Virginia all participate in The Academic Common Market. This program offers tuition savings to students if an institution in their home state does not offer them the program that they are looking to study.

The Midwest Student Exchange Program offers students in Illinois, Indiana, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, or Wisconsin a similar benefit.

The New England Board of Higher Education offers a tuition break program referred to as the New England Regional Student Program. This allows students that are permanent residents in the states of Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont to receive tuition aid. With this program, students may qualify if the out-of-state college they would like to attend is closer to home than an in-state college that offers the same academic program.

6. Hire an expert

In-State Angels helps students and families navigate the often confusing process of establishing residency in a different state. Avoid the risk of going at this by yourself and employ an Angel to help. ISA helps students gain residency in the fastest and most legal way possible, saving families like yours tens of thousands of dollars.

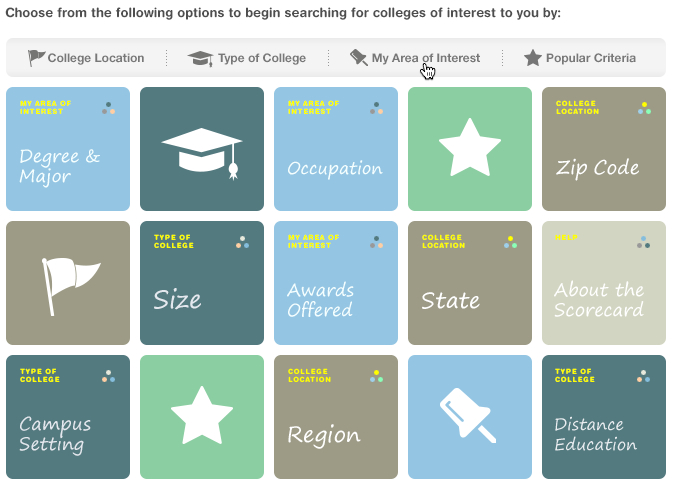

These tips can help you and your student by opening up as many college options as possible, even those you originally thought to be too expensive. Like we’ve been saying, it pays to do your research, so get searching and start saving!

______________________________________

About the Author – Jake Wells founded In-State Angels in 2009 after graduating from the University of Colorado-Boulder with more debt than seemed reasonable. He is on a mission to prevent others from suffering a similar fate, and now advises students on how to get in-state tuition in the fastest way legally possible.

Over 3 million college students will attend universities outside of their home state this year. With the yearly costs of a private or out-of-state education starting at $24,000, any added expenses beyond room and board, books and tuition can be a real burden. Yet, not having your kids home for the holidays is unimaginable for many parents, so they find a way to make it happen.

Over 3 million college students will attend universities outside of their home state this year. With the yearly costs of a private or out-of-state education starting at $24,000, any added expenses beyond room and board, books and tuition can be a real burden. Yet, not having your kids home for the holidays is unimaginable for many parents, so they find a way to make it happen.