It’s Tuesday. It’s not hump day. It’s the day before New Years Eve and time to reflect on 2014. And nothing says Tuesday more than Tips. Put it all together and you have Tuesday’s Top 10 Tips from 2014.

It’s Tuesday. It’s not hump day. It’s the day before New Years Eve and time to reflect on 2014. And nothing says Tuesday more than Tips. Put it all together and you have Tuesday’s Top 10 Tips from 2014.

Tip #1: Insist your student graduate in 4 years or less

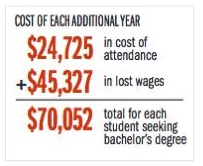

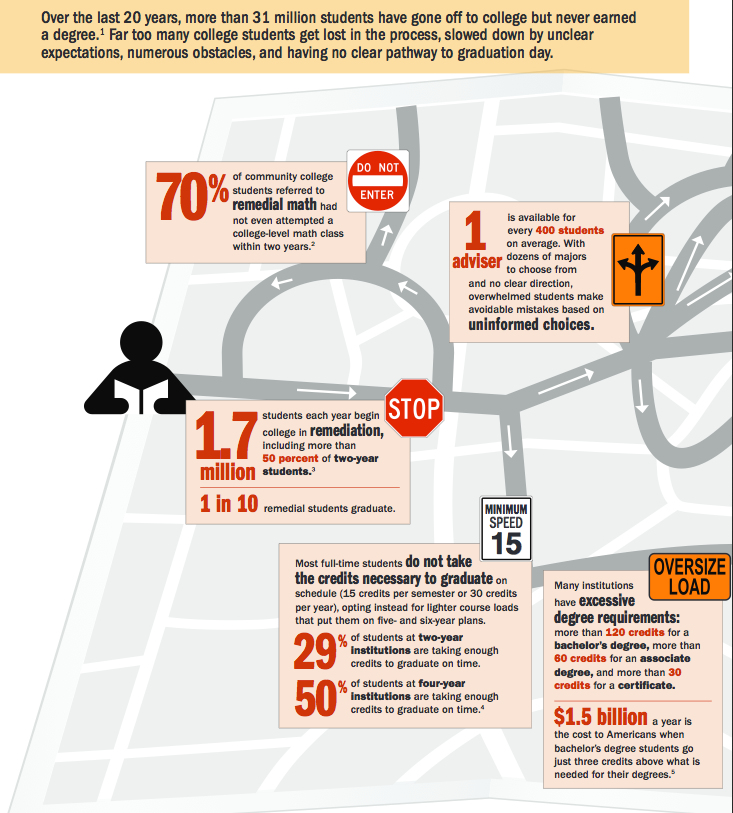

Did you know that at most public universities, only 19 percent of full-time students earn a bachelor’s degree in four years? Even at state flagship universities — selective, research-intensive institutions — only 36 percent of full-time students complete their bachelor’s degree on time.

Nationwide, only 50 of more than 580 public four-year institutions graduate a majority of their full-time students on time. Some of the causes of slow student progress are inability to register for required courses, credits lost in transfer and remediation sequences that do not work. Studying abroad can also contribute to added time and credits lost when abroad. According to a recent report from CompleteCollege.org some students take too few credits per semester to finish on time. The problem is even worse at community colleges, where 5 percent of full-time students earned an associate degree within two years, and 15.9 percent earned a one- to two-year certificate on time.

Tip #2: Be wise—apply to backup schools (but make sure those schools are ones you want to attend)

Being admitted into your first choice school is a challenge and not a guarantee. No matter how positive you are about your application, no matter how hard you’ve worked to be an ideal applicant, it is important not to assume that gaining admission to your top choice for college is a sure thing. But don’t get dejected or cynical! Here are three ways to increase your chances of being accepted by applying to backup schools.

Tip #3: It’s never too early to prepare for college

How early is too early to prepare for college? We’ve all seen those movie clips where the parents are agonizing over the right preschool to prepare their kids for the right kindergarten, the right grade school, and the right college preparatory school. These overachieving parents are convinced that college prep begins at birth. They take it to a whole other level elevating college jerseys into full blown college prep. But just how early is too early and how far should parents go when preparing their children for college?

Tip #4: It matters very little where your student goes to college

Much is debated about college names and prestige, especially among parents. It’s logical that parents want their kids to have the best opportunities available. It’s illogical that they place more value in the name than in the education itself. But so many parents encourage their kids to make illogical college choices. Where you go to college is not as important as you might think.

Tip #5: Don’t neglect the college visit

A few years ago, I wrote an article for Smart College Visit about the importance of the college visit: Don’t Pick a College Sight Unseen:

As a parent of two kids who attended college, I learned a very valuable lesson: never pick a college sight unseen. The rules that apply to any major purchase are even more important when making the decision to invest thousands of dollars on a college education. You would never buy a car without test-driving it, or move into a home without taking a walk through and getting a home inspection. Based on my experience with both my kids, I can tell you that your teen should never accept admission to a college without getting a feel for the campus and campus life.

Tip #6: Know when to hold ‘em; know when to fold ‘em

In just a few short months, your student will be making college decisions by the May 1st deadline. For some families, it’s easy. For others, it’s emotional and gut wrenching. If your student got into their dream college and the money is there, congratulations. If your student was waitlisted, or there’s a financial issue, or they didn’t get an offer of admission to their first choice college it’s time to examine the deck. By doing this, you can help your teen make the best decision.

Tip #7: Practice tough love

Parenting is easy if you give into your child’s every whim, never be consistent with discipline, or simply don’t pay attention. Parenting children who strive for excellence in everything requires some tough love. And tough love is not easy; especially when it comes to the raising a motivated, educated, and successful student.

How do you, as a parent, raise a child that’s motivated to strive for excellence where their education is concerned?

Tip #8: Listen to college podcasts

Every day I grab my trusty iPod and head to the mall to do my 2.5 miles of walking. I hate walking. To me, it’s boring and a waste of my time. However, it’s critical to my health and every day I tell myself it’s just something I have to grin and bear.

But then I discovered podcasts. Not only are they great when exercising, you can listen when you’re cooking dinner, commuting to work on public transportation, eating your lunch, or any other time that you are performing daily tasks and want to make them more productive.

Tip #9: Don’t ignore the FAFSA

The most important advice I can give parents is: don’t ignore the FAFSA! Many parents are misinformed when it comes to the Free Application for Federal Student Aid (FAFSA). They believe that they make too much money to qualify for any kind of financial aid—and they decide not to file. That is the worst mistake you can make. I encourage every family of a college-bound senior complete the FAFSA (and complete it before February 1).

Tip #10: Teach your teens the value of money

Before you send your teens off to college, they need to learn about the value of money. Ideally, it starts at an early age; but if you haven’t started, there’s no time like the present!

When your children are away at college they are going to be responsible for their own spending (and saving). There will be offers galore from credit card companies because college students are their biggest target market. If they hook them while in college it usually means they have them for the rest of their lives.

What is lost when a student doesn’t graduate in 4 years?

What is lost when a student doesn’t graduate in 4 years?

Today’s topic: applying EA (early action) and ED (early decision). It’s the first week of November and those applications will be arriving at the colleges. Granted, it’s a quick process to complete once school begins in the fall, but there are some good reasons to take advantage of these options.

Today’s topic: applying EA (early action) and ED (early decision). It’s the first week of November and those applications will be arriving at the colleges. Granted, it’s a quick process to complete once school begins in the fall, but there are some good reasons to take advantage of these options.