Savoring the last few months of high school education, your student may get the ping of fear in the back of their mind to find the right college. Researching and applying to colleges has most likely left your student with stress, excitement and anticipation of the future.

Whether your student searched for colleges with online classes or universities that offer top-notch academic programs, the applications have been submitted and the wait contines? While you and your student are waiting for offers of admission from the colleges, here are some tips for making the transition to college easier:

You’re not there yet

Many seniors take the attitude that once their applications are submitted they can coast through the remaining months of senior year. That is not the case. Many colleges require a spring or final transcript and have been known to reject offers for admission based on that transcript. Encourage your student to buckle down and do their best these next few months. Colleges are looking for students that take their education seriously. The last thing they want to see are grades that have dropped since they received your student’s application.

What you need to take to the dorm

What you need to take to the dorm

Once your student gets into a university, it’s easy to forget half the stuff they need when moving day comes. For the bedroom and main areas, grab two sets of sheets and pillows, a trash can, desk and area lamps, a laundry bag or basket, storage boxes, a mini fridge and a coffee maker. Life isn’t complete without electronics. Remember the laptop, iPod and dock, headphones, alarm clock, TV, DVD player, cell phone and charger, camera and a microwave.

Cleaning is now up to your student, so bring along a vacuum or old-fashioned carpet sweeper. In the bathroom, they will want soap, shampoo, toothbrush and paste, towels, a comb and a razor. For their desk, grab some Post-It notes, a compact stapler, printer paper, note cards, pens and pencils.

Finding a roommate

Finally, the college may allow students to choose their own roommate. If they don’t have a friend lined up, they can find a roommate through roomsurf.com. They will be matched with potential rooming partners based on the results of a survey. They can communicate with potential roomies beforehand to make sure they’re a match. If assigned a roommate, make contact with them online by searching social media like Facebook, Twitter and Google. Contact beforehand allows your student the opportunity to plan and not bring duplicate items for the dorm room.

While entering college is exciting, it can seem overwhelming. With these tips, you’ll have a much easier time getting started and moving forward. Soon, they will be settled in and on their way!

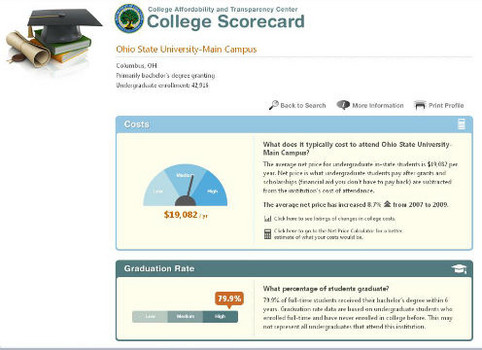

It is estimated that by the time a single child reaches the age of 18, his parents will have spent approximately $300,000, according to the U.S. Department of Agriculture (which releases annual reports on family spending). And that doesn’t include the cost of college. Of course, this report factors in housing, childcare, food, transportation, healthcare, and a number of other elements. But it comes out to about $13,000-14,000+ per year in expenses for a child in a median-income household (earning roughly $60,000-100,000 annually in taxable income). Unfortunately, your costs don’t end when your kids head off to college. In fact, they could increase significantly. You’ll still have to pay for your own home, car, food, and more, but you’ll also be on the hook for additional living expenses for your kids since they are no longer at home, not to mention tuition, books, fees, and other costs associated with college – unless of course you decide not to pay.

It is estimated that by the time a single child reaches the age of 18, his parents will have spent approximately $300,000, according to the U.S. Department of Agriculture (which releases annual reports on family spending). And that doesn’t include the cost of college. Of course, this report factors in housing, childcare, food, transportation, healthcare, and a number of other elements. But it comes out to about $13,000-14,000+ per year in expenses for a child in a median-income household (earning roughly $60,000-100,000 annually in taxable income). Unfortunately, your costs don’t end when your kids head off to college. In fact, they could increase significantly. You’ll still have to pay for your own home, car, food, and more, but you’ll also be on the hook for additional living expenses for your kids since they are no longer at home, not to mention tuition, books, fees, and other costs associated with college – unless of course you decide not to pay.