Parents of college-bound teens look forward to filing the FAFSA as much as they look forward to filing their income taxes. It’s a federal form and all federal forms aren’t exactly user friendly. Many parents are so intimidated by the form that they choose not to file, telling themselves that their student wouldn’t qualify for aid anyway because they make too much. But don’t fall into that trap.

Here are 10 good reasons to file the FAFSA:

1. College is expensive

Even if you’re rich and can afford to pay for your child’s education, it’s expensive. Why would you pass up an opportunity to help with some of the cost?

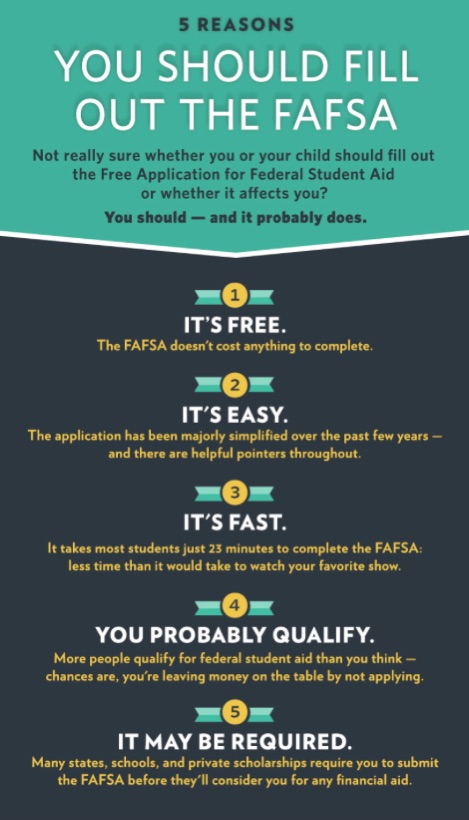

2. It’s FREE

That’s right. It’s completely free to complete the FAFSA. You’ll spend some of your time completing the FAFSA and you could get thousands of dollars of financial aid in return. So one could say, it’s BEYOND free–they pay you!

3. Getting help is easy and FREE

If you get stumped, help is available using the online help tool or by submitting a question at the FAFSA web site or calling the help number listed on the site. Many schools even host a FAFSA day where they offer help to parents and students on how to complete the free form.

4. FREE money could be waiting for you

According to a recent Reuters article, about 1.8 million lower income undergraduates who might have qualified for aid neglected to file the FAFSA and missed out on financial aid. No matter what your income level, you should file the FAFSA because there is more money out there to be awarded than just need-based aid.

5. Federal money

The federal government provides over $80 billion dollars in grants, loans and work-study programs every year. The only way to get pell grants, perkins loans, stafford loans and other federal aid is by submitting the FAFSA. Federal loans offer the best interest rates and repayment terms for student borrowers and are superior to private student loans.

6. State money

FAFSA is the gatekeeper for state financial aid programs. Each state’s programs are different but they all require the FAFSA to distribute the funds. Check with your state’s higher education agency for deadlines and requirements. In some states the financial eligibility ceilings are much higher.

7. School money

Colleges and private scholarship sponsors offer billions of dollars in financial aid. Even if you don’t have financial need, you may be eligible for these awards. Some school and private scholarship programs are specifically designed for students who were rejected by federal financial aid. Some schools will not award merit aid unless you complete the FAFSA.

8. Scholarship applications ask if you’ve applied

In addition to the aid that a student may receive from federal and state agencies, many scholarship applications include a box to check asking whether the student has submitted a FAFSA. According to Monica Matthews of How to Win College Scholarships, “Scholarship providers want to know that the student is doing everything possible to get financial help in paying for college and submitting the FAFSA is a very important step in the process.”

9. You have two or more children in college

With two in college, your expected family contribution (what the parents can afford to pay) drops by 50%. Even if you didn’t get financial aid with the first, file the FAFSA because having a second child in college can net you some financial aid.

10. You really don’t have a choice

Look at it this way: FAFSA is the ONLY way to be considered for federal, state and college financial aid. Even if you don’t NEED the aid you still want to get it. Who doesn’t want FREE money?

It’s FAFSA time. “Yuck”, as one parent said. “Dreading, dreading, dreading” from another. “It’s my least favorite time of year (other than income taxes)”, said another. I get it. Nobody likes filling out federal forms, especially when money is on the line. And with the FAFSA, money is on the line.

It’s FAFSA time. “Yuck”, as one parent said. “Dreading, dreading, dreading” from another. “It’s my least favorite time of year (other than income taxes)”, said another. I get it. Nobody likes filling out federal forms, especially when money is on the line. And with the FAFSA, money is on the line.