Sign up for my FREE parent tips email and get my FREE Ebook on college financing! Or subscribe to my blog via email on the left.

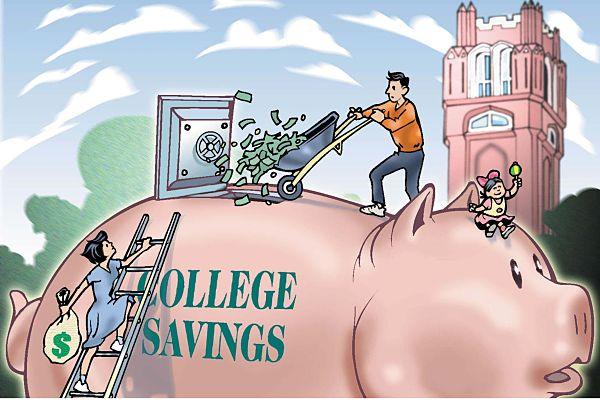

No matter where you are in the college prep process, saving, and knowing how and what to save can be difficult to understand. Depending on your situation and the amount of time you have to save, here are some excellent resources that will help you understand college savings plans.

No matter where you are in the college prep process, saving, and knowing how and what to save can be difficult to understand. Depending on your situation and the amount of time you have to save, here are some excellent resources that will help you understand college savings plans.

SavingforCollege.com

SavingforCollege.com offers a free Family Guide to College Savings available in either Kindle, Nook, or PDF format. The guide advises parents on when to start saving, how to start saving, and college savings alternatives. It also gives a brief explanation of the tax savings you can expect and how to maximize savings. There are also numerous links on the site itself related to 529 savings plans, college expenses, and a tool to use to view the list of state specific plans. There is also a college cost calculator that helps you determine the cost of college based on your child’s age and the amount you wish to contribute along with a monthly savings estimate.

AffordableCollegesOnline.org

AffordableCollegesOnline.org has created a 529 Savings Plan Guidebook which can be easily printed from your browser. In the guidebook you will gain a better understanding of:

By using this guide, you will gain a better understanding of:

- How 529 savings plans work and how to establish one

- Who is eligible to establish and contribute to a 529 savings plan

- The pros and cons of other types of college savings vehicles

- How much may be contributed to a 529 plan

- The tax advantages associated with 529 plans

- The best time to set up a plan

- How to take the next step in obtaining some – or all – of the funds that are needed to fulfill the dream of a higher education.

U.S. News Education

On U.S. News Education: Saving for College you can read articles like:

- 4 Steps to Choosing Age-Based 529 Plans

- 5 Steps for Utilizing 529 College Savings Plan Funds

- 12 Questions to Ask Before Investing in a Prepaid College Savings Plan

- 4 Costly Mistakes Parents Make When Saving Money for College

Manilla.com

Manilla.com offers a free downloadable Financial Literacy toolkit that helps parents and students through the process of deciding how to pay for college, deciding who will pay for what, and some good pointers on establishing good financial habits.

Fidelty.com

Fidelity offers information you will need to plan your child’s educational future. On this site you can compare your savings options, find a 529 savings plan that meets your needs, learn about financial aid, and how much you will need to save.

MorningStar

Morningstar, Inc. is a leading provider of independent investment research in North America, Europe, Australia, and Asia. Morningstar provides data on approximately 433,000 investment offerings, including stocks, mutual funds, and similar vehicles, along with real-time global market data on nearly 10 million equities, indexes, futures, options, commodities, and precious metals, in addition to foreign exchange and Treasury markets.

In a recent article, MorningStar rated the nation’s Best 529 Savings Plans for 2013 and also lists the negative rated 529 plans.

University Parent

University Parent, an online resource for parents of college students and college bound teens, recently published an article: What is a 529 Savings Plan? How it Helps. The article gives an overview of the plans and what you need to know once you have one and how to use it.

If your college-bound teen is young, you have plenty of time to start saving. If you have a student in high school, you should read the information about aggressive portfolios and how to maximize your investment. The above resources should help you decide how much and where to invest your savings.

If you have a college-bound teen you’re well aware of the cost of college–it’s high. In a

If you have a college-bound teen you’re well aware of the cost of college–it’s high. In a