Do you have questions about who fills out the FAFSA? This infographic should help:

Here’s a great post from the College Board in honor of Financial Aid Awareness month for parents, reminding all of us of the importance of the FAFSA and how to get ready for submission.

It’s time.

The Free Application for Federal Student Aid (FAFSA) is how millions of students apply for federal, state and most college-based financial aid. And because government grants compose 74 percent of this $185 billion pool, it’s understandable for families to feel anxious when filling out the FAFSA.

It doesn’t have to be that way. Susan McCrackin, Senior Director Financial Aid Methodology at the College Board, offers this eight-step map to help parents and students work through the FAFSA as efficiently and effectively as possible.

1. Gather Your Documents

It is much easier to fill out the FAFSA if you have all the needed forms in hand before you start. Here’s a list of documents to get you going. You should also get a U.S. Department of Education personal identification number (PIN.) Here’s the PIN application link.

2. Think About Taxes

Parents’ taxes are an important part in the FAFSA process. Getting taxes done by February 1st may be unrealistic, so last year’s taxes and this year’s paystubs can help create estimates. After February 3rd, the IRS Data Retrieval Tool becomes available, allowing students and parents to access the IRS tax return information needed to complete the FAFSA and transfer the data directly into their FAFSA from the IRS website. And if you owe the government money, take note: you can complete your taxes without actually filing and cutting a check to Uncle Sam.

3. Find Quiet Time

The FAFSA has a lot of sections. Breaking them into smaller pieces makes the FAFSA easier to navigate. Consider these do’s and don’ts.

4. Stay Student Focused

Parents often forget that the student always provides information. Parents are required to provide their information if the student is dependent.

So when parents see a question that refers to “I,” remember that “I” is the student. “You” is also the student. When questions address parents, you will see questions that refer to “your parents.” This is where parental information goes.

5. Avoid Parent Traps

As families evolve, so do questions about who needs to provide information for the FAFSA. When you see “parents,” FAFSA is referring to the student’s biological or adoptive parents. When the parents are married, then the student and both parents complete the FAFSA.

If the parents are not together, things can get confusing. BigFuture by the College Board created a corresponding infographic to help address some commonly asked questions. That infographic will appear on this site tomorrow.

6. Keep Track of Deadlines

Every college has a different set of deadlines based on priority, merit, early decisions etc. BigFuture by the College Board helps families sort through these deadlines with detailed college profiles and a free, customized action plan. And, should you have specific questions about specific colleges or universities, don’t be afraid to call the college’s financial aid office and ask questions.

7. Profile CSS/Financial Aid PROFILE®

The FAFSA opens the doors to federal aid. There’s also almost $50 billion in non-federal aid available – from colleges, states and private institutions. Some colleges and programs use the College Board’s CSS/Financial Aid PROFILE to help award these monies.

CSS/Financial Aid PROFILE is an online application that collects information used by almost 400 colleges and scholarship programs to award financial aid outside sources from the federal government. Families must complete the application and the College Board sends it to the colleges and scholarship programs they have chosen.

Here’s a list of colleges that use CSS/Financial Aid PROFILE® and where you go to complete the CSS/Financial Aid PROFILE®. Sending your CSS/Financial Aid PROFILE® report to one college or scholarship program costs $25. Additional reports are $16 each. There are fee waivers available for low-income families.

8. Gain Experience

The more you experience something, the better you do. This free FAFSA webinar walks you section by section through an actual application with the College Board’s Senior Director for Financial Aid Methodology, Susan McCrackin. Families can access the free FAFSA webinar 24/7.

It’s time. Go after your piece of the more than $185 billion in financial aid to help make college possible. Use BigFuture for advice and to help create a customized plan for your child. Then follow the map. Chances are it will lead to an investment that provides returns for the rest of your child’s life.

Last night in the #CampusChat discussion we were talking about moving into college and what to pack. One participant stated she took her whole life with her to college because she never planned to move back home after college graduation; and to her credit she did not.

Last night in the #CampusChat discussion we were talking about moving into college and what to pack. One participant stated she took her whole life with her to college because she never planned to move back home after college graduation; and to her credit she did not.

Most parents believe (or hope) that once their student goes off to college they will only be temporary visitors at home. We often talk about getting into college, but rarely discuss what happens after graduation. Unfortunately, in today’s economy, many students are forced to move back in with their parents after they graduate. For those boomerang students, the top two reasons are no job or job prospects and too many student loans exceeding their expected income.

These reasons alone make it important for parents to be involved in the financial decisions that their students make related to the college they choose and the loans they choose to incur while attending. Of course your student may WANT to go to an expensive private college, but can you, as a family, afford it? Is your student prepared for the ramifications of taking out massive student loans and not being able to repay them?

After the student returns home three scenarios usually play out.

Scenario One

Your student returns home and still can’t find a job with their college degree. After weeks of depression and frustration, they make the decision to attend graduate school. Since it’s expensive, they opt to take out graduate student loans to supplement the financial aid and provide living expenses. After they complete their graduate degree, they are able to gain employment and begin paying back their loans.

Scenario Two

Your student finds a minimum wage job, defers their student loans and still can’t find a job related to their college degree and major. They end up working in a field that is completely unrelated to their area of interest, in a job they do not like, and are still unable to pay back their student loans. They borrowed too much and will probably never crawl out of the hole they dug for themselves.

Scenario Three

Your student returns home, finds a minimum wage job, defers their student loans and saves every penny they make while living at home. They are able to begin paying back their student loans with their savings and continue the job hunt while working full time. Many times, those temporary jobs end up being avenues to find college degree employment either through networking or company advancement.

With scenario one, if your son or daughter opts to pursue the graduate degree path, it’s critical they do their homework, research interest and payback rates, and degrees that are worth their investment. If they don’t, they could end up as the student in the second scenario with too much debt and no job prospects.

Advise your student wisely about debt, college value, and degree prospects after graduation. It’s not just a decision on which school they “like”. It’s a decision that affects the rest of their life and could have overwhelming negative consequences. Parents are key role players in this decision. It’s our job to point out the possible ramifications of their decisions and allow them to have input. But (and this is is hard) if they won’t listen to reason, you might have to be a parent. I know because I had to take that role with my daughter and her college choice. I had to be the “bad guy” and kept her from attending her first choice college. Today she thanks me. At the time, she wasn’t very happy with me–but she fell in love with her second choice college and graduated with minimal debt.

Being a parent can be extremely hard; we have to balance guidance with “helicoptering” and know when to take a stand for the well-being of our kids. It’s a difficult job on the best of days and downright frustrating on the worst of them. Helping them with the college choice as it relates to financial consequences is one of those “take a stand” moments.

I’m hearing more and more from parents that they are desperate for help and answers. It seems they are drowning in the sea of college information out there. They don’t know who to listen to, where to go for help, and how to make the best use of the help they find.

There are two tools that will answer every question you ever had about how to handle the multitude of questions related to the college admissions process: my Parents Countdown to College Toolkit AND Paul Hemphill’s Plan for College Videos. Both resources will help you help your student navigate the college maze. If you own both you can finally sleep at night!

For a limited time only (until September 30th), Paul and I are offering parents a 2 for 1 special–buy my Parents Countdown to College Toolkit and you receive a FREE subscription to Paul’s Plan for College Video Series. These tools can save your family hundreds or even thousands in college costs and help you help your student market themselves to the colleges, thus receiving multiple scholarships.

If you’re a parent of a college-bound teen, you can’t afford to pass up this opportunity. You and your student will have the peace of mind, knowing that all your questions are answered and you have done everything you can to help them get into their first choice college (with scholarships and merit-aid, of course!).

The Wall Street journal posted an article today, “Tough Times for Colleges–and College Towns”, about the tough times that colleges are facing.

The Wall Street journal posted an article today, “Tough Times for Colleges–and College Towns”, about the tough times that colleges are facing.

The outlook isn’t good. Bain, which markets its consulting services to universities, and Sterling Partners, which invests in education companies, examined the balance sheets from 2006 to 2010 of schools in their report. They found many schools operating on the assumption that the more they build, spend and diversify the more they will prosper. They have become overleveraged, with long-term debt increasing at an average rate of about 12% a year and average annual interest expense growing at almost twice the rate of instruction-related expense.

Schools have been trying to plug the gap by jacking up tuition at rates that aren’t sustainable. The result is a fiscal hurdle that dozens of second- and third-tier public and private schools won’t be able to clear. Hundreds of schools—including some of the most prestigious institutions in the country—have tightened their belts.

It looks like the colleges are struggling, much like the students and families. Unfortunately, you know that the financial problems that colleges are experiencing will be passed along to the students by either tuition hikes or reductions in merit aid. That is not good for students and their families, especially the ones who make too much to quality for need-based aid.

What does that mean for this year’s crop of seniors? You better investigate the financial outlook of your college choices carefully and do some digging on their past merit-aid distributions over the last several years, especially if you are counting on that to pay for college.

Continue reading College Debt = Higher Tuition and less Merit Aid

Did you know, the average college student graduates with about $22,000 in debt. The problem is, most of these students qualify for essentially free money for college but never apply. So, to help these and other students get the money they definitely need, this infographic on how to get free money for college through state and federal grants, as well as scholarships and more should be helpful. Some of the highlights include —

From: Online Colleges Blog

Most parents are shocked when I tell them to ignore the college sticker price printed in the book, catalog, or college info site. Why do they “say” it costs X amount of dollars and not charge what the printed price states? Because while most can’t pay the price, some can. It’s the same with any commodity: houses, cars, airfare, vacations, and more. They post a price because many will pay that price; others who can’t will search for the bargain. Enter the college admissions process with the mind of a bargain hunter and you’ll be pleasantly surprised what you will pay.

Following is an infographic that makes it easy to comprehend:

Created by: Online University

Parents of college-bound teens look forward to filing the FAFSA as much as they look forward to filing their income taxes. It’s a federal form and all federal forms aren’t exactly user friendly. Many parents are so intimidated by the form that they choose not to file, telling themselves that their student wouldn’t qualify for aid anyway because they make too much. But don’t fall into that trap.

Here are 10 good reasons to file the FAFSA:

Even if you’re rich and can afford to pay for your child’s education, it’s expensive. Why would you pass up an opportunity to help with some of the cost?

That’s right. It’s completely free to complete the FAFSA. You’ll spend some of your time completing the FAFSA and you could get thousands of dollars of financial aid in return. So one could say, it’s BEYOND free–they pay you!

If you get stumped, help is available using the online help tool or by submitting a question at the FAFSA web site or calling the help number listed on the site. Many schools even host a FAFSA day where they offer help to parents and students on how to complete the free form.

According to a recent Reuters article, about 1.8 million lower income undergraduates who might have qualified for aid neglected to file the FAFSA and missed out on financial aid. No matter what your income level, you should file the FAFSA because there is more money out there to be awarded than just need-based aid.

The federal government provides over $80 billion dollars in grants, loans and work-study programs every year. The only way to get pell grants, perkins loans, stafford loans and other federal aid is by submitting the FAFSA. Federal loans offer the best interest rates and repayment terms for student borrowers and are superior to private student loans.

FAFSA is the gatekeeper for state financial aid programs. Each state’s programs are different but they all require the FAFSA to distribute the funds. Check with your state’s higher education agency for deadlines and requirements. In some states the financial eligibility ceilings are much higher.

Colleges and private scholarship sponsors offer billions of dollars in financial aid. Even if you don’t have financial need, you may be eligible for these awards. Some school and private scholarship programs are specifically designed for students who were rejected by federal financial aid. Some schools will not award merit aid unless you complete the FAFSA.

The FAFSA only asks about the income and assets of the custodial parent. For financial aid purposes, the custodial parent is the one who has cared for the student for the majority of 2011. If the custodial parent earns a modest income, a student could qualify for financial aid.

With two in college, your expected family contribution (what the parents can afford to pay) drops by 50%. Even if you didn’t get financial aid with the first, file the FAFSA because having a second child in college can net you some financial aid.

Look at it this way: FAFSA is the ONLY way to be considered for federal, state and private financial aid. Even if you don’t NEED the aid you still want to get it. Who doesn’t want FREE money?

********

For a different perspective, visit my colleague Wendy David-Gaines’ blog (POCSMom) for 10 Reasons NOT to file a FAFSA.

Wendy was a (POCSmom) Parent of a College Student and was once a pre-POCSmom as well. She likes to help parents de-stress during the college process and has written a book of stories and anecdotes to help parents see the lighter side of college.

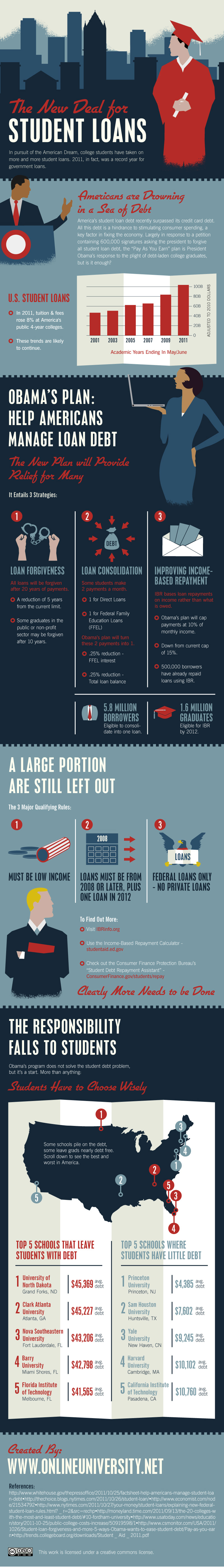

Here’s an infographic outlining the Obama Plan to help student’s with their student loan debt. But is it enough? In my opinion, the only way to look toward the future is to educate our kids about debt and make wise college choices that allow them to graduate with little or no debt. It’s not a “new deal”…just a band-aid.

Created by: Online University

Two-thirds of college seniors graduated with loans in 2010, and they carried an average of $25,250 in debt. They also faced the highest unemployment rate for young college graduates in recent history at 9.1%. The new report, Student Debt and the Class of 2010, includes average debt levels for the 50 states and District of Columbia and for more than 1,000 U.S. colleges and universities.

Part of your college decision process is based on cost factors. Examining states who have low student debt might open possibilities to your student that you might not have otherwise considered. You can also view individual colleges to determine the amount of average student debt giving you additional information to help you make wise financial college choices.

If you click on the graphic above you can use the interactive map to learn about the colleges your student is considering. Be an informed parent and teach your student about financial college responsibility.