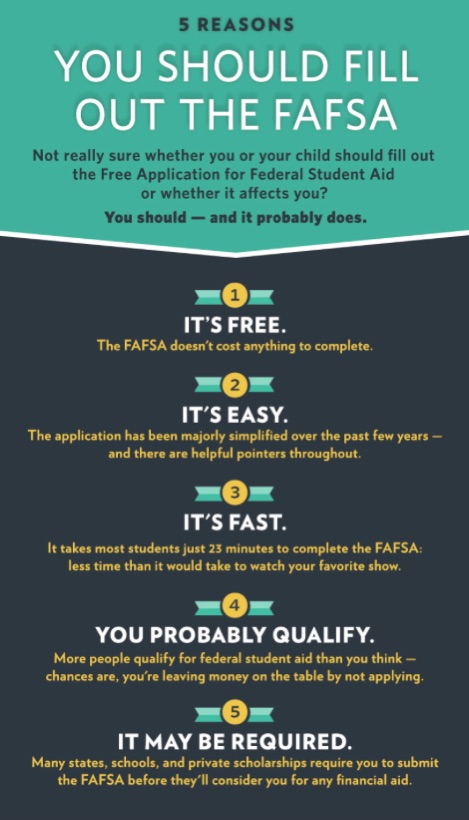

Paying for college is an uphill battle filled with mindboggling FAFSA paperwork and a steady stream of education bills. Stress due to how individuals will pay for college, housing, textbooks, and extra fees can be a continual buzz at the back of the mind. In order to avoid thousands upon thousands of dollars in student loans, college students and their families can strategically make financial and professional decisions that will maximize the amount of federal and company student aid they will receive.

Paying for college is an uphill battle filled with mindboggling FAFSA paperwork and a steady stream of education bills. Stress due to how individuals will pay for college, housing, textbooks, and extra fees can be a continual buzz at the back of the mind. In order to avoid thousands upon thousands of dollars in student loans, college students and their families can strategically make financial and professional decisions that will maximize the amount of federal and company student aid they will receive.

Employer-Provided Educational Assistance

Students, prospective students, and parents can decrease the out of pocket cost of college by pursuing a job at a company that has educational assistance or scholarship programs. Many smaller companies have a long history of providing scholarships for their employees and their employee’s children.

On April sixth of this year, Starbucks led the employer educational program charge by offering to pay for the tuition for all part and full-time employees. Employees can choose any one of the 49 undergraduate programs at Arizona State University online program. Beyond Starbucks, there are dozens of employers who have educational benefits programs. The majority of the programs offer anywhere from $1,000 to $5,250 in educational aid per year.

Students should also look into deducting their education from their taxes as a work-related fringe benefit. Educational fringe benefits help professionals seek the education required when they meet one of the following requirements:

- They are required to receive the education by their employer or the law to keep their salary, status, or job.

- The education will help improve or maintain a skills needed for your job.

They also cannot:

- Allow you the possibility of entering a new field.

- Allow you to receive minimum educational requirements for your field.

Does it sound like you might qualify? What individuals can deduct is just as expensive. You can dive further into the topic here.

Extended Family Contributions

Your grandma or grandpa planning on helping you pay for college? Before they write you a check, you can strategize how and when the grandparents help you pay for college to minimize what they pay in taxes and maximize how much financial aid you receive.

First off, grandparents can maximize the financial benefits of aiding their grandchildren by sending the tuition money directly to the college. Paying the tuition directly qualifies the educational contribution as a gift tax exclusion. What does this mean? The grandparents will not need to report the contribution to the IRS.

It should be noted that only tuition is considered a gift tax exclusion. If family members want to help students with other educational expenses, the money qualifies as a gift tax expense. The family member should tally the amount given to the student. If the amount is less than $14,000, the amount given does not need to be reported. Anything over the $14,000 must be reported by the individual who gave the gift. No taxes will need to be paid on the gift until the individual has given more than $5.34 million.

Don’t rush off to tell your grandparents the good news yet. Here’s the bad news: If they help you pay for college this year, it will decrease the amount you will receive in financial aid next year. Unfortunately the people at FAFSA assume if they help you this year, they’ll continue to offer the same amount of aid the following year. You can prevent this fatal mistake by advising your grandma or grandpa to wait until the last year or two of college before helping out.

Paying for college can be expensive, but it can be manageable by developing a game plan. Business educational assistance and familial educational gifts utilized at the right time can be the beginning to a successful financial strategy to pay for college.

____________________________________

Today’s guest blogger, Samantha Stauf, was a first generation college student. Since Samantha graduated two years ago, she’s spent her free time writing articles meant to help current students succeed. You can find her on Twitter at the hashtag @samstauf.