Today is April Fool’s day. I have to admit, it’s not one of my favorite Hallmark holidays. I’m not much of a prankster and I always disliked being on the receiving end of a prank. None of us do. But colleges, all over the country, are pranking parents and students today. How? With the financial aid award letter. But don’t be fooled.

Today is April Fool’s day. I have to admit, it’s not one of my favorite Hallmark holidays. I’m not much of a prankster and I always disliked being on the receiving end of a prank. None of us do. But colleges, all over the country, are pranking parents and students today. How? With the financial aid award letter. But don’t be fooled.

Colleges don’t back their admission offer up with money–if a college wants your student, they will back it up with a financial “reward”. No award indicates they are counting on your student declining their offer. Read this…

Colleges pack those letters with loans–a prank because every student and parent can get a student loan. Read this…

Colleges misrepresent their true cost on those letter–often leaving out expenses that should be considered and not giving the true cost of attendance. Read this…

Colleges “gap” students–they don’t award enough financial aid to meet the family’s EFC. This leaves a gap in the award and what the family has to pay. Read this…

Colleges consider it an award letter although there’s no award–even if all they offer is a student loan. That’s not an award. That’s not even an olive branch. It’s a slap in the face. Read this…

Be a wise consumer. Don’t be fooled by award letters. Do your due diligence and compare offers, crunch the numbers, and make a wise financial decision. Remember that part of the perfect fit college is the financial aspect. A college who won’t back their offer up with money isn’t a college you should consider.

Don’t be pranked by the colleges. I would never fool you; but Happy April Fools Day!

Read Wendy’s post: How a Joke Helps No Fooling College Prep

++++++++++++++++++++++

Wednesday’s child may be full of woe but Wednesday’s Parent can substitute action for anxiety. Each Wednesday Wendy and I will provide parent tips to get and keep your student on the college track. It’s never too late or too early to start!

The bonus is on the fourth Wednesday of each month when Wendy and I will host Twitter chat #CampusChat at 9pm ET/6pm PT. We will feature an expert on a topic of interest for parents of the college-bound.

Wednesday’s Parent will give twice the info and double the blog posts on critical parenting issues by clicking on the link at the end of the article from parentingforcollege to pocsmom.com and vice versa.

It’s FAFSA time. “Yuck”, as one parent said. “Dreading, dreading, dreading” from another. “It’s my least favorite time of year (other than income taxes)”, said another. I get it. Nobody likes filling out federal forms, especially when money is on the line. And with the FAFSA, money is on the line.

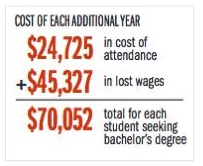

It’s FAFSA time. “Yuck”, as one parent said. “Dreading, dreading, dreading” from another. “It’s my least favorite time of year (other than income taxes)”, said another. I get it. Nobody likes filling out federal forms, especially when money is on the line. And with the FAFSA, money is on the line. What is lost when a student doesn’t graduate in 4 years?

What is lost when a student doesn’t graduate in 4 years?