With a new school year quickly approaching, many parents are figuring out how their child is going to afford college. According to CollegeBoard, the average student budget for the 2019-20 academic year was $26,590 for students attending a four-year university. This figure includes the cost of living on campus, which may be required of incoming freshman students.

This means your child’s education could cost well over six figures. And no parent wants their child to start their adult life with that amount of debt.

As a parent, you can help guide your child to make smart decisions that will impact their finances for years to come. This begins with choosing an affordable school.

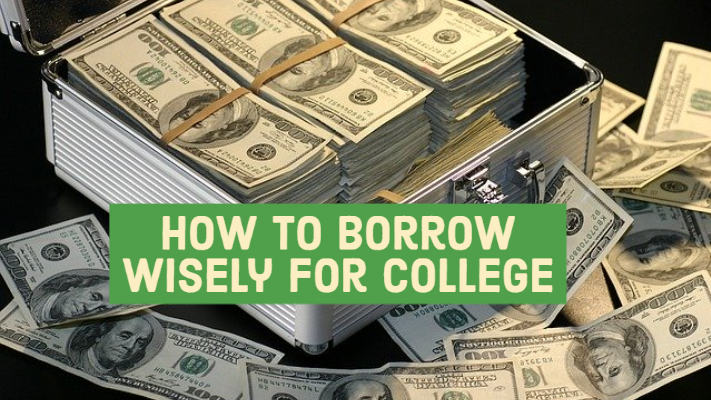

There are also other ways to help pay for the cost of attendance and living expenses. Here’s how to help fund college costs and ways to borrow wisely.

Apply for financial aid opportunities before borrowing

Before you or your child take on debt to pay for college, you should exhaust all other available resources.

Your child can access financial aid opportunities, like grants, scholarships and work-study programs, by completing the Free Application for Federal Student Aid (FAFSA).

The FAFSA filing window is October 1 to June 30 for each upcoming academic year. Keep in mind that some financial aid is available on a first-come, first-serve basis, and cutoff deadlines vary by state. Encourage your child to complete their application as early as possible.

Also explore third-party scholarship opportunities through your employer, local community organizations and online databases. Each additional scholarship or grant — even if it is only for a few hundred dollars — can prevent your child from taking on more student loan debt.

How to borrow wisely for college

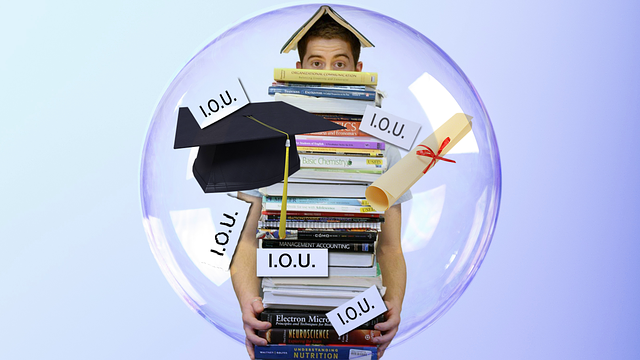

Once your family has explored all financial aid opportunities and pooled existing resources (e.g. 529 college savings plan and other family contributions), your child may still need to turn to student loans.

Whether your child is taking out loans in their own name or you’re borrowing on their behalf, it’s important that your family only borrow what is needed to fill the remaining financial gap.

The first way to approach student loans is through federal loans. Federal loans have more flexibility and have certain protections and benefits. This is why it’s best to maximize federal loan opportunities before taking out private loans.

For example, your child can enroll in a repayment plan that matches their financial situation and may be eligible for loan forgiveness opportunities.

Your child should borrow funds in this order:

- Direct Subsidized Loans. Subsidized loans typically have the lowest rates, and the government will cover any interest that accrues while your child is in school.

- Direct Unsubsidized Loans. Unsubsidized loans aren’t need-based, so any student can qualify for them. However, your child is responsible for the interest that accrues during school.

- Private loans. Your child will likely need a cosigner to qualify for a private loan. Shop around with various private lenders to find the lowest rate and best terms for your credit.

You may also have the option to take out a federal Parent PLUS loan in your name to help fund your child’s education.You’ll be solely financially responsible for the loan — not your child.

Make a debt repayment plan

Student loan borrowers should always be aware of interest charges that will accrue during school and after graduation. These charges should be included in their overall financial plan.

Your child should also start making a debt repayment plan as soon as possible. Popular student loan repayment methods include enrolling in an income-driven repayment (IDR) plan or refinancing student loans after graduation to get a lower interest rate.

When considering refinancing federal loans into private student loans, it’s important to understand the consequences of losing out on federal benefits and protections, like loan forgiveness and forbearance.

The earlier your child plans for their educational costs, the more likely they can save money during their college experience and beyond.

____________________________________________________________________

Our guest post today is by Travis Hornsby, CFA, and Founder and CEO of Student Loan Planner. He lives with his wife in St. Louis, MO, where he loves thinking up new student loan repayment strategies and frequenting the best free zoo in America. As one of the nation’s leading student loan experts, he has consulted on $500 million of student debt personally.