Sign up for my FREE parent tips email and get my FREE Ebook on college financing!

During our student’s senior year of high school we live in a bubble. All sights are set on one goal—getting into college. Students and parents focus on college selection, college applications, financial aid forms, and then we wait. We wait for the offers of admission to come pouring in and then we compare financial aid packages and help them pack their bags for college.

But wait. Is it really that simple? Hardly. Most parents would say it’s anything but simple; it takes work, commitment and perseverance on both parts—parents and students. Before your student sends off those applications, you should know the truth about college.

Acceptance doesn’t mean graduation

Did you know that graduation rates differ wildly from school to school. About 400,000 students drop out of college each year. When you research the college, look up their graduation rates. Low rates could send up a red flag. True, graduation rates don’t determine the quality of a degree. Yet students who start college but don’t finish are typically no better off than those who never even started, and in some cases might be worse off, if they took on debt.

I owe, I owe, so off to work I go (if they can find a job)

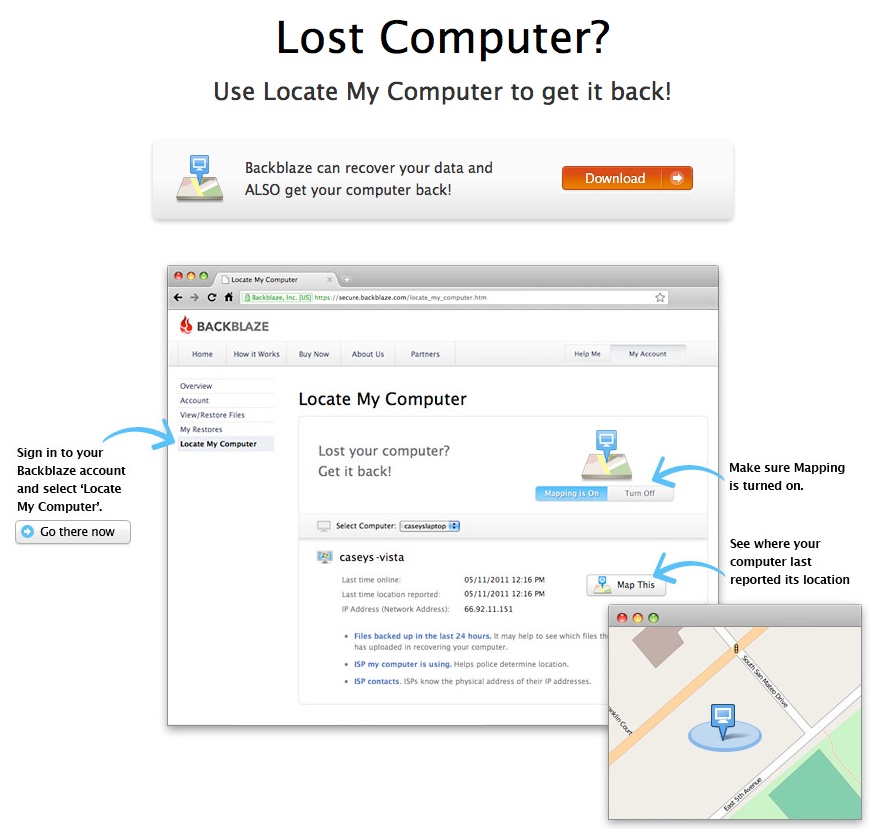

Even if your student graduates, it’s no guarantee they will secure a job; at least not one that will pay enough to cover too much student loan debt. Having that conversation about college costs should be a priority before they apply.

According to the College Board and other statistical resources student loan debt among graduates is at an all-time high:

•As of Quarter 1 in 2012, the average student loan balance for all age groups is $24,301. About one-quarter of borrowers owe more than $28,000; 10% of borrowers owe more than $54,000; 3% owe more than $100,000; and less than 1%, or 167,000 people, owe more than $200,000.

•In 2010‑11, about 57% of public four‑year college students graduated with debt. They had borrowed an average of $23,800 (in 2011 dollars). About two‑thirds of those earning bachelor’s degrees from private nonprofit institutions had debt averaging $29,900.

Be cautious about student loans and if at all possible avoid them.

Will they stay, or will they go?

As many as one in three first-year students don’t make it back for sophomore year. The reasons run the gamut from family problems and loneliness to academic struggles and a lack of money. If schools you’re considering have a low freshman retention rate, you’ll want to ask the admissions office why. Some colleges do a great job of taking care of their freshmen; some don’t. That’s why it’s important to look at these rates when making college choices.

It’s a jungle out there

Even if you and your student do everything right, there’s going to be bumps in the road. They will call complaining of roommates, homesickness, and frustration with their classes. The best thing to do is listen and know that most times, those complaints get less and less and they eventually cease after they have settled in. Don’t be surprised if this happens to your bright, self-sufficient independent student. Just one word of advice—fight the urge to rescue them. It’s time they learn to fight their own battles.

If you have a college-bound teen you’re well aware of the cost of college–it’s high. In a

If you have a college-bound teen you’re well aware of the cost of college–it’s high. In a