If you have children who will be graduating from college, you may be wondering how you can support them on their journey as they enter into the real world and make adjustments to their new lives.

It is a scary world out there and if your child is entering a completely new career field, he or she may be nervous and unsure of what to do.

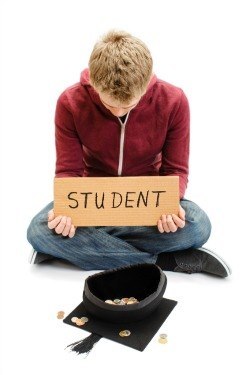

When it boils down to it, many students face college graduation with an enormous amount of student loan debt and what this does is it sets them up for failure in the real world if they are unable to pay the debt down quickly.

Imagine if your child had $30,000 in student loan debt and could not transition out of their minimum wage job and into their chosen career even with a degree. That is tough to think about, right? Unfortunately, it is the real world and this happens all of the time.

You may be sitting back right now scratching your head and wondering what it is you can do to help support your child once they have graduated college. We do have some ways that we think are feasible for the both of you and will help you two form a closer bond in the process.

Let’s take a look at some of the ideas below.

- Cosign on Student Loan Refinancing

If you have never dealt with student loans before, then you may have never heard about student loan refinancing. This is okay.

Student loan refinancing is a way for your child’s student loans to be reworked and the interest rate to be lowered. This results in a lower monthly payment and lower overall interest that needs to be paid on the loan itself. Sometimes, students are able change their student loan term period as well.

When it comes time to refinance, your child will quickly realize that there are some strict requirements to do so and if they do not meet these requirements, they cannot refinance. Your child must have a good credit score, good credit history, and a stable job.

Many new graduates do not have the minimum requirements for a bank or private lender to refinance them and they are told they need a cosigner. If you want to help support your child, you may want to consider being a cosigner on the loan, so that they can refinance it. It is possible to have your name removed as the cosigner later on down the road too.

Let’s look at an example to show you how much your child could save. Let’s start out with a loan balance of $20,000 at an 8.6% interest rate with 10 years to pay on the loan. The current monthly payment on the loan is $249 and the total interest paid over 10 years is $9,885.

If we refinance that loan, so $20,000 at a 3.25% interest rate for a period of 10 years, the new monthly payment would be $195 and the total interest paid over 10 years is $3,453.

Simply helping your child refinance in the scenario above would save your child a total of $54 per month and a lifetime savings of $6,433 in interest payments alone.

- Make a Payment Agreement for Debt

Another way you can help you student is by helping them pay down some of their debt. For instance, if their debt totals $15,000 and you have the money to spare, maybe you can use the money to pay off their debt and then work out a payment plan with them to pay you back.

This will benefit them because they will save money on interest payments. If you wanted to, you could charge interest on the amount you pay off too, but your interest charge is not going to be anywhere near that of a bank.

In addition, you may be able to work something out with your child where you will help pay off a credit card bill and in return they can install new fencing around your home and so on.

It is important that you and your child lay out the terms of the deal BEFORE any money is paid out or BEFORE any benefits have been had. You want to make sure you have a commitment from them that they will pay you back.

- Help Your Child Budget and Build Credit

If you have never taught your child about personal finance, now is the time. It is important for your child to have a solid foundation to build upon. Finances are not easy to manage when you do not know what you are doing.

You can help your child budget with the money they have as well. For example, sit down with your child and determine how much money they make, how much their bills are, and their necessities. From there, work with them on how to create a budget and where they should be sending their money. The more you help them, the more they will learn.

Lastly, make sure you help them build their credit and teach them about credit. The worst thing you can do for your child is let them blindly get a credit card and treat it like cash or like it does not have to be paid back. This will only breed bad financial behavior and your child will be confused when his or her credit score is in the 400 or 500 range.

Final thoughts on supporting your children after college graduation

As your child enters into the real world, he or she will need your support and it would be helpful for them if you were there. If you are unable to help them financially, you can still support them by providing them with the guidance they need to make payments on time, build their credit score, and not allow their loans to go into default.

Over 3 million college students will attend universities outside of their home state this year. With the yearly costs of a private or out-of-state education starting at $24,000, any added expenses beyond room and board, books and tuition can be a real burden. Yet, not having your kids home for the holidays is unimaginable for many parents, so they find a way to make it happen.

Over 3 million college students will attend universities outside of their home state this year. With the yearly costs of a private or out-of-state education starting at $24,000, any added expenses beyond room and board, books and tuition can be a real burden. Yet, not having your kids home for the holidays is unimaginable for many parents, so they find a way to make it happen. Dear High School Junior,

Dear High School Junior,