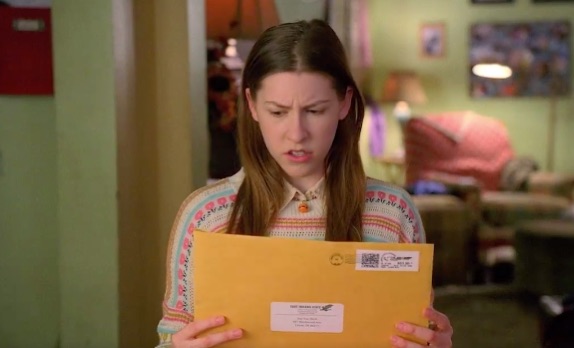

Slowly high school is trickling to an end. Many parents and students are already waist deep in the college application process. Unfortunately, simply receiving that much anticipated college acceptance letter does not inevitably lead to a joyous (and expensive) graduation ceremony. Getting into college, in some ways, is the easiest step.

Slowly high school is trickling to an end. Many parents and students are already waist deep in the college application process. Unfortunately, simply receiving that much anticipated college acceptance letter does not inevitably lead to a joyous (and expensive) graduation ceremony. Getting into college, in some ways, is the easiest step.

According to US News, one in three freshman drop out of college within their first year. And to make matters more dire, some national universities only have a retention rate of 58%. While students drop for a variety of reasons, recent technological advancements can help students at least ensure they do not drop out due to academic difficulty. Here are a few pieces of modern marvels that students might want to consider investing in:

Gamification of Education

As a student, nothing is more aggravating than doing homework, discovering you did every single problem wrong, figuring out what you did wrong, and then remembering you know have an ‘F’ that will drag down your grade. It’s aggravating and demoralizing. You might ace the test, but it might not be enough.

One solution is to ensure you’re enrolled in classes that utilizes technology and gamification to help students learn. Many on campus and on-line courses utilize a personalized learning environments to guide students through their coursework without penalizing them for not getting it right the first time. ASU has branched out by incorporating into many of their Astronomy and History classes online personalized learning environments.

The Astronomy course, HabsWorldBeyond, presents complicated math problems and then allows you to create a hypothesis, test the hypothesis, and then discover exactly where your calculations went wrong. The end goal here is to learn. Not to understand complicated concepts from the get-go. (I would recommend trying to sign up for courses that utilize some type of gamification.)

Students can also stream line the learning process by picking up educational tabletop games. Rather than spending hours building flash cards and trying to will yourself to memorize them, you can pick up a game that will allow you to actively engage with and/or utilize that knowledge.

Here are a few educational games to check out:

- Covalence: A Molecule Building Game by Genius Games

- Meltdown: A Cooperative Chemistry Game By Play EFG

- Antimatter Matters: A Quantum Physics Board Game (Really!) by Elbowfish

You might also check out if you can find any board games in a language you are attempting to learn. Instead of getting an English version of Monopoly or Catan purchase a Spanish, German, French version.

Smart Pens

Smart pens (AKA digital pens) can revolutionize how students take, store, and find class notes. Instead of lugging around a heavy laptop or carrying around five different notebooks. The student just carries a lightweight pen and one notepad.

Everything written with the digital pen is stored in the smart device and can be transferred over to one of their electronic devices. Once transferred over, the software and apps created in conjunction with the pen can be used to turn their hand-written notes in text. The notes can then be transferred to whatever word processor the student prefers. (And at that point students can sort the notes by subject.) The text version of the notes can then be quickly searched with a simple Control F when the student needs to study or complete assignments.

Some smart pens even have the added capability of taking audio recordings as the student which can then be played back allowing individuals to hear the lecture while looking at the attached notes. If you’re interested in further research on smart pens here are a few models if you might want to check out)

Recording Devices

Recording devices are valuable tools in their own right and far cheaper at this point than a smart pen. Just as re-reading a book can lead to a more advanced understanding with each exploration, re-listening to lectures can grant greater understanding of the subject matter with each listen.

They’re particularly useful when trying to learn a new language (something that many majors require). Sometimes in language classes (particularly higher level ones where the professor won’t speak English) re-listening can help by allowing students to look into words, phrases, and concepts that went right over their head the first time around.

If you do decide to invest in a recording device, you might want to hold off on recording any of the lectures in small classrooms until you can ask for the professor’s permission.

Apps

As of July 2015, both the Android and Apple app stores had over 1.5 million apps. While downloading the latest free game of the week, future and current students might want to search for apps that can help them study, complete their assignments, and supplement their education. I imagine at this point, if you think of an educational topic and then think, I wish there was an app for that, there probably is an app for that.

There are flash card apps that help students study without investing money and time to creating paper flash cards.

There are apps to help students with their math homework. Students scan the math problem or input the math problem and the app creates a step by step solution to the problem. While the apps can be used to cheat, more savvy and dedicated students can utilize them to ensure their problems are correct and discover where they might have gone wrong.

Finding apps that offer knowledge or simulations of the subject matter they are taking can be a good supplement. These astronomy apps might be useful for students enrolled in an astronomy course.

The successful completion of college can be a difficult endeavor. Students can’t always control all aspects of their life that might derail their college education, but they can give themselves the best chance to succeed academically by investing some of their funds or just some of their time finding the right technology to supplement their education.

_________________

Today’s guest blogger, Samantha Stauf, was a first generation college student. Since Samantha graduated two years ago, she’s spent her free time writing articles meant to help current students succeed. You can find her on Twitter at the hashtag @samstauf.

This past week, I’ve been discussing the financial aid awards and how they affect your student’s college choice. When those

This past week, I’ve been discussing the financial aid awards and how they affect your student’s college choice. When those

In London, you see signs and tourist shirts everywhere that say “Mind the Gap”. If you ride their underground transportation system, you will hear them announce “mind the gap” at each station. It’s a warning for passengers to be aware of the distance between the train and the train platform.

In London, you see signs and tourist shirts everywhere that say “Mind the Gap”. If you ride their underground transportation system, you will hear them announce “mind the gap” at each station. It’s a warning for passengers to be aware of the distance between the train and the train platform.

Slowly high school is trickling to an end. Many parents and students are already waist deep in the college application process. Unfortunately, simply receiving that much anticipated college acceptance letter does not inevitably lead to a joyous (and expensive) graduation ceremony. Getting into college, in some ways, is the easiest step.

Slowly high school is trickling to an end. Many parents and students are already waist deep in the college application process. Unfortunately, simply receiving that much anticipated college acceptance letter does not inevitably lead to a joyous (and expensive) graduation ceremony. Getting into college, in some ways, is the easiest step.