This week is FAFSA week. An entire week devoted to the FAFSA. Today, I am debunking some FAFSA myths.

As the week progresses, I’m going to scour the my blog, the web, and social media to find you the best information, tips and advice related to the FAFSA. If you’re not sure it’s worth your time, this advice should answer that question. If you want to be informed before you complete the form, this information will most definitely help.

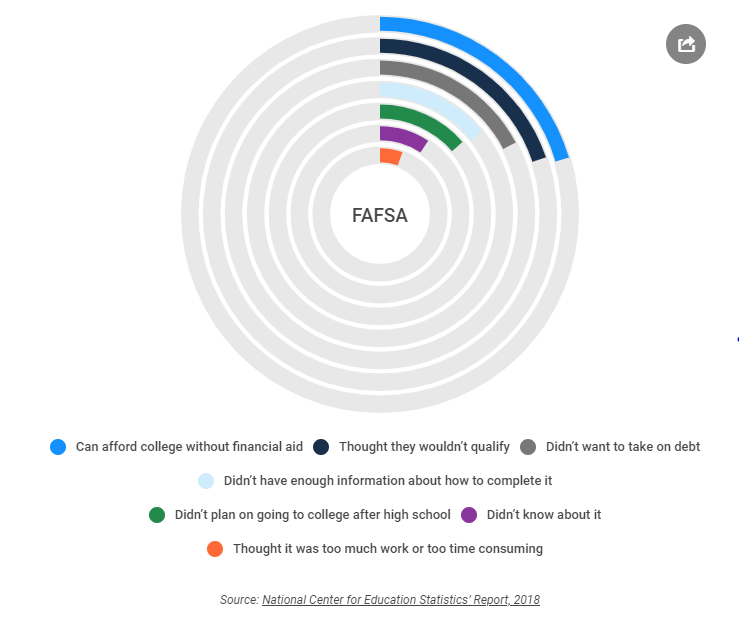

Myth 1: If you can’t qualify for federal aid, there’s no point in filing out the FAFSA.

Reality: There’s more to the FAFSA than federal aid. Colleges use this form to disburse merit aid and grants. Also, if your student is considering a student loan or you are considering a Parent PLUS loan, you must complete the FAFSA. In addition, many states use your FAFSA data to determine your eligibility for their aid and many scholarships ask if you have completed the FAFSA.

Myth 2: I make too much money to qualify for financial aid.

Reality: There is no income cut-off to qualify for federal student aid. Many factors—such as the size of your family and your year in school—are taken into account. Your eligibility for financial aid is based on a number of factors and not just your income.

Myth 3: I have too many assets to qualify for aid.

Reality: Most colleges won’t care if you own a house and won’t count home equity against you if you do. The majority of schools rely on the federal aid application, FAFSA, which doesn’t ask parents if they own a home. If the college requires the CSS Profile, home equity is required, but because of the equity cap, has little impact on the award decision. In addition, money in qualified retirement plans, such as a 401(k), 403(b), IRA, pension, SEP, SIMPLE, Keogh and certain annuities, is not reported as an asset on the FAFSA.

Myth 4: I didn’t qualify for financial aid last year, so filling out the FAFSA form again is just a waste of time.

Reality: It’s super important to fill out a FAFSA form every year you’re in college. Why? Because things can change. For instance, your school or state might create a new grant or scholarship, or the factors used to calculate your aid could change from one year to the next. Either way, if you don’t submit a new FAFSA form, you’re out of luck.

Myth 5: The form is too complicated and since I’m sure I won’t qualify, it’s a waste of my time.

Reality: The FAFSA is actually pretty straightforward and can be completed in one sitting; and filing out the FAFSA is never a waste of your time. Colleges and states use this information when awarding grants and scholarships. (See Myth 1)

The bottom line: there is no excuse to not complete the FAFSA. It’s free and is well worth your time. Even if you can afford to pay for the entire cost of college, you should complete the FAFSA. Colleges use this data when dispersing merit aid as well.

Financial aid can be a confusing part of the

Financial aid can be a confusing part of the

It’s FAFSA time. “Yuck”, as one parent said. “Dreading, dreading, dreading” from another. “It’s my least favorite time of year (other than income taxes)”, said another. I get it. Nobody likes filling out federal forms, especially when money is on the line. And with the FAFSA, money is on the line.

It’s FAFSA time. “Yuck”, as one parent said. “Dreading, dreading, dreading” from another. “It’s my least favorite time of year (other than income taxes)”, said another. I get it. Nobody likes filling out federal forms, especially when money is on the line. And with the FAFSA, money is on the line.