Sign up for my FREE parent tips email and get my FREE Ebook on college financing!

It’s a confusing process–figuring out how to pay for college. Not only is it stressful, but it’s overwhelming trying to understand all the ins and outs of everything to do with financing a college education. Two women, Jodi Okun and Celest Horton, are doing something about it. In two separate projects, each of them is doing their part in making college affordable while graduating without debt or minimal debt.

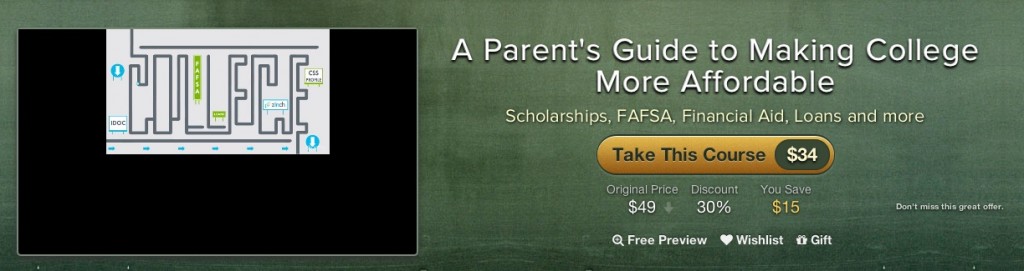

A Parent’s Guide to Making College More Affordable

Jodi Okun has partnered with Zinch to create A Parent’s Guide to Making College More Affordable for the busy parent who wants straightforward and simple, yet thorough answers on how to navigate the confusing process of paying for college. Jodi has been working in the college financial aid industry for over six years. She began working at Occidental and Pitzer College in their financial aid offices helping thousands of families as a financial aid consultant. Jodi is also the founder of College Financial Aid Advisors, where she works closely with families to successfully navigate the financial aid process.

A Parent’s Guide to Making College More Affordable consists of the following content:

– Over 30 video lessons covering:

- The cost of college including creating financial aid timelines & using the net-price calculator

- All about applications – FAFSA, CSS PROFILE, IDOC, NCP

- What to do after you’ve applied including comparing packages and how to follow up

- How to cover the gap through grants, loans, etc.

– 14 hours of live “office hours” with Jodi Okun where you can connect with her directly and privately to ask questions related to your unique family situation.

– Detailed, step-by-step walk-throughs on how to complete important applications: the CSS Profile (released in October) and the FAFSA (released in January) at no additional cost.

– college timeline, budget worksheets and a downloadable dictionary of key terms.

– Q&A postings after each lecture to ask Jodi specific questions.

– Lifetime access to all course content and a 30-day money back guarantee.

A Parent’s Guide to Making College More Affordable

How to Pay for College HQ

Celest Horton is a mother of four kids: three of the four are teenagers now. She is a Chemical Engineer by trade and has spent most of her professional career in technical sales in the Oil Industry. Yet, she wanted to help serve others too by solving a current fear that she has…paying for college for four kids. Having three of the four in college at the same time is her greatest financial concern.

She wants to help others understand how simple it can be with a little planning and preparation. To do this, Celest is producing and making available How to Pay for College HQ Podcasts. It’s a weekly podcast that is comprised of interviews with industry experts to educate high school parents and students to help them plan and prepare early with the goal to earn a degree debt free.

It is estimated that by the time a single child reaches the age of 18, his parents will have spent approximately $300,000, according to the U.S. Department of Agriculture (which releases annual reports on family spending). And that doesn’t include the cost of college. Of course, this report factors in housing, childcare, food, transportation, healthcare, and a number of other elements. But it comes out to about $13,000-14,000+ per year in expenses for a child in a median-income household (earning roughly $60,000-100,000 annually in taxable income). Unfortunately, your costs don’t end when your kids head off to college. In fact, they could increase significantly. You’ll still have to pay for your own home, car, food, and more, but you’ll also be on the hook for additional living expenses for your kids since they are no longer at home, not to mention tuition, books, fees, and other costs associated with college – unless of course you decide not to pay.

It is estimated that by the time a single child reaches the age of 18, his parents will have spent approximately $300,000, according to the U.S. Department of Agriculture (which releases annual reports on family spending). And that doesn’t include the cost of college. Of course, this report factors in housing, childcare, food, transportation, healthcare, and a number of other elements. But it comes out to about $13,000-14,000+ per year in expenses for a child in a median-income household (earning roughly $60,000-100,000 annually in taxable income). Unfortunately, your costs don’t end when your kids head off to college. In fact, they could increase significantly. You’ll still have to pay for your own home, car, food, and more, but you’ll also be on the hook for additional living expenses for your kids since they are no longer at home, not to mention tuition, books, fees, and other costs associated with college – unless of course you decide not to pay.