As the costs of college keep rising each year, many students and their families find it necessary to rely on financial aid to help pay for college. There are many different types of financial aid available, and knowing which one best matches your situation is key to not only choosing the right type of aid, but also maximizing the amount that you can qualify for—and minimizing your debt obligations later on.

Financial aid is a critical part of the college application and attendance process. It can make college a reality for many students and help bridge the gap between family contributions and the overall cost of attendance. Some types of aid don’t need to be paid back; others can leave you in debt for years to come.

With that in mind, it’s important to understand how to best approach the financial aid process, and how to set yourself up for financial success later by putting thought into the process now.

What Should You Start With?

The first step in the financial aid process should be completing the FAFSA. Short for the Free Application for Federal Student Aid, the FAFSA walks you through a complete picture of your finances. If you’re a dependent student—most first-year students are—then it also includes questions about your parents’ financial situation and their potential ability to assist in funding your education.

The federal government is the biggest source of financial aid for college students, and before it’ll consider you as eligible for aid, you’ll need to complete the FAFSA, which serves as your application for all federal aid. The FAFSA is completed online, it’s free, and there is plenty of help available to assist you and your family in filling it out.

What’s the Takeaway from the FAFSA?

Once your FAFSA is submitted to the federal government along with your choices of colleges, a Student Aid Report, or SAR, is generated from the information you entered. The SAR explains how much your expected family contribution (EFC) is. The government takes the position that it’s your responsibility to pay as much as you can to your own education first; the EFC is how much the Department of Education thinks you and your family should be able to contribute to the total cost.

Each year, colleges publish an amount called the cost of attendance. It includes all the expenses that go into attending that school: tuition, room and board, textbooks, fees, and other things like living expenses throughout the school year. Your EFC is subtracted from the Cost of Attendance, and the resulting balance is considered your financial need. The federal government sends your SAR to the schools you listed, and they compile a financial aid package to offer you.

Your federal financial aid package could include a variety of aid products including Pell grants, unsubsidized and subsidized federal student loans, and more. You should always consider Pell grants and subsidized federal aid first. A Pell Grant is a type of aid that does not require repayment, and subsidized loans do not accrue interest while you’re attending school.

After looking at your offer, you may find that your financial aid package isn’t enough to cover the entire bill, but there are other options to consider such as scholarships.

Should You Consider Scholarships?

The short answer is “YES, absolutely!” Scholarships, like grants, are essentially free money that you don’t have to pay back. They should always be a consideration regardless of what year you are in college. You can apply for new ones every year, and there are tons of sources to find scholarships. They can really make up the difference up between the cost of attendance and your financial aid package. Start early and often. If the FAFSA wasn’t so important, this would be the first place to start.

There are thousands of scholarships available every year, but they’re highly competitive. Each program has its own application criteria and deadlines, and the best way to maximize your chances of winning one is to ensure that you follow the program’s directions and meet all of the deadlines—preferably applying as early as possible. The best way to go about winning scholarships is to just keep on applying to any legitimate opportunity you can find.

Is There a Last Resort?

If you find there’s a funding gap left over after scholarships, grants, and other federal aid, then you still have one option: a private student loan. There are distinct differences compared to federal student loans do, but sometimes they’re a necessary tool to cover that funding gap.

Offered by banks, credit unions, and other lenders, private student loans are based upon your creditworthiness; as a result, most students find that they need a qualified cosigner for approval. Further, you may find even the best private student loans still have high interest rates compared to federal loans. After all, interest rates are generally higher for private loans. Also, they don’t come with a grace period like a federal loan. That means you’ll need to start paying it back immediately, just like a car loan or mortgage, even if you’re still in school.

It is clear that private student loans are not as desirable compared to their federal counterparts; however, sometimes they’re a viable option if it’s crunch time.

__________________________________________________

Today’s guest post is By Matt, the site manager & webmaster of The Student Loan Report – a student loan news and education website.

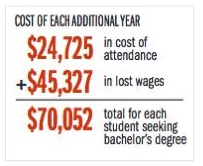

What is lost when a student doesn’t graduate in 4 years?

What is lost when a student doesn’t graduate in 4 years?